AML Checking Service

From as little as £1.60 per search.

Know your clients

With our award-winning Anti-Money Laundering Identity Checking Service

The TaxCalc Solution to AML compliance

If you are an accountant, bookkeeper or other finance professional, the Money Laundering Regulations 2007 (as amended 2012) mean that you need to know your client before you act for them. If you provide services to clients, you have a legal obligation to keep anti-money laundering records. Failure to take your obligations seriously could mean penalties ranging from fines to imprisonment.

Experts you can trust

Run in partnership with the global leader in identity and credit checking service, Equifax, TaxCalc AML Identity Checking compares any information provided by clients to corroborate their authenticity.

Featuring seamless integration with Practice Manager, it's easy to to run checks using the data you already hold in TaxCalc – saving you time and increasing productivity when on-boarding clients and verifying their compliance with Money Laundering Regulations.

Sectors that legally require relevant anti-money laundering records:

- Accountancy practices

- Auditors

- Bookkeepers

- Payroll agencies

- Tax advisors and/or those that prepared tax returns

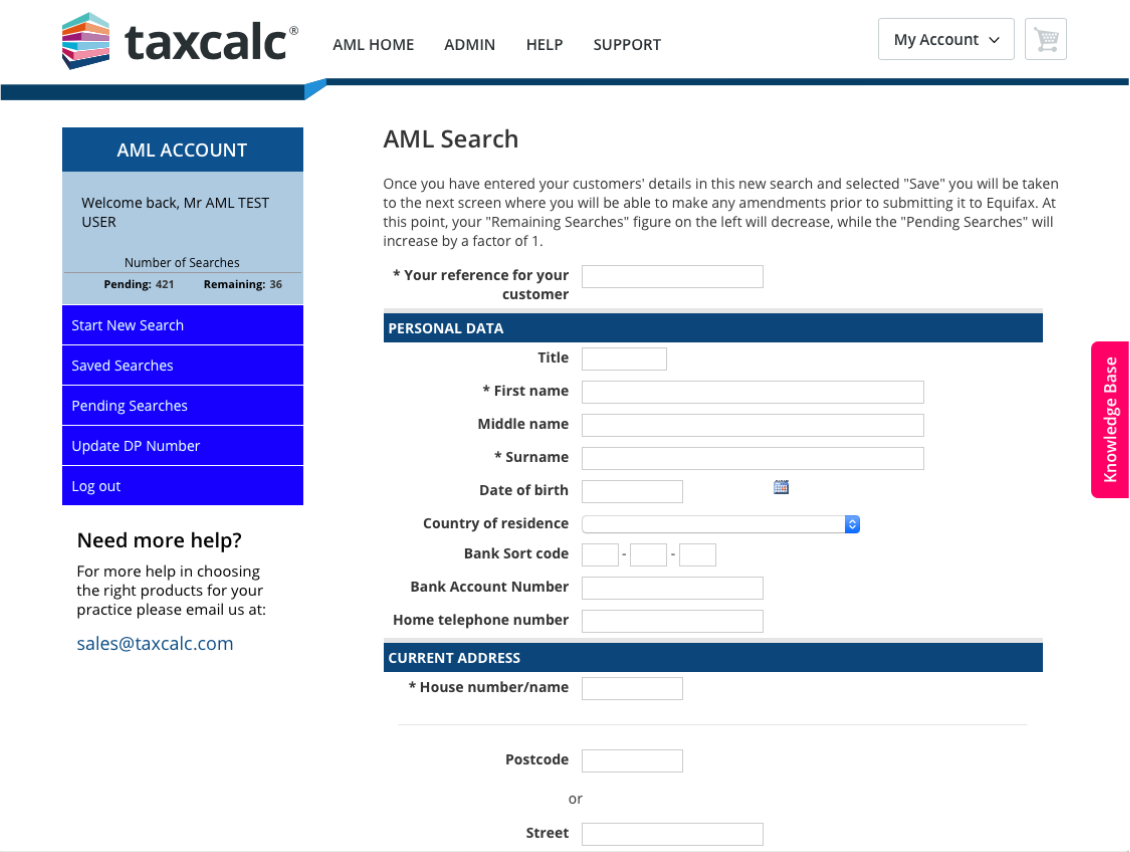

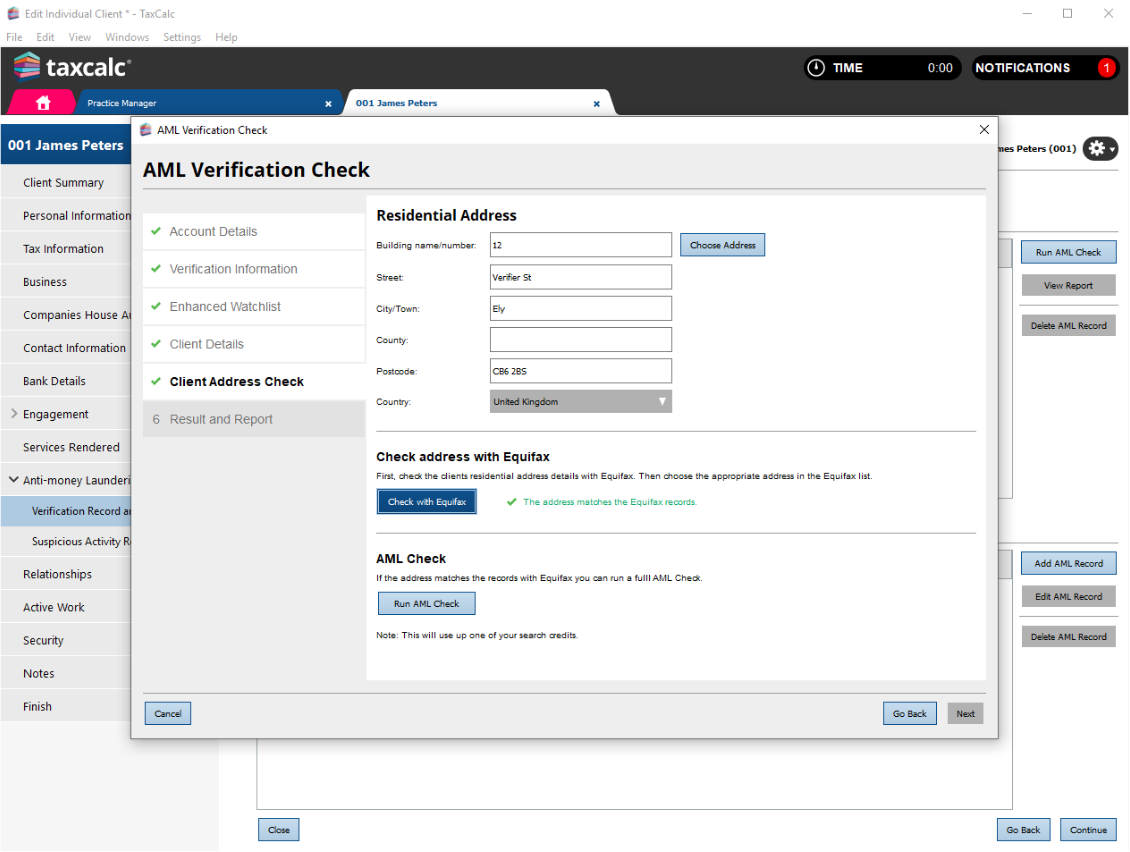

As part of your engagement process, simply enter the name, address and other information about your prospective client into the system.

All known data about your client is passed securely and electronically to Equifax for instant processing.

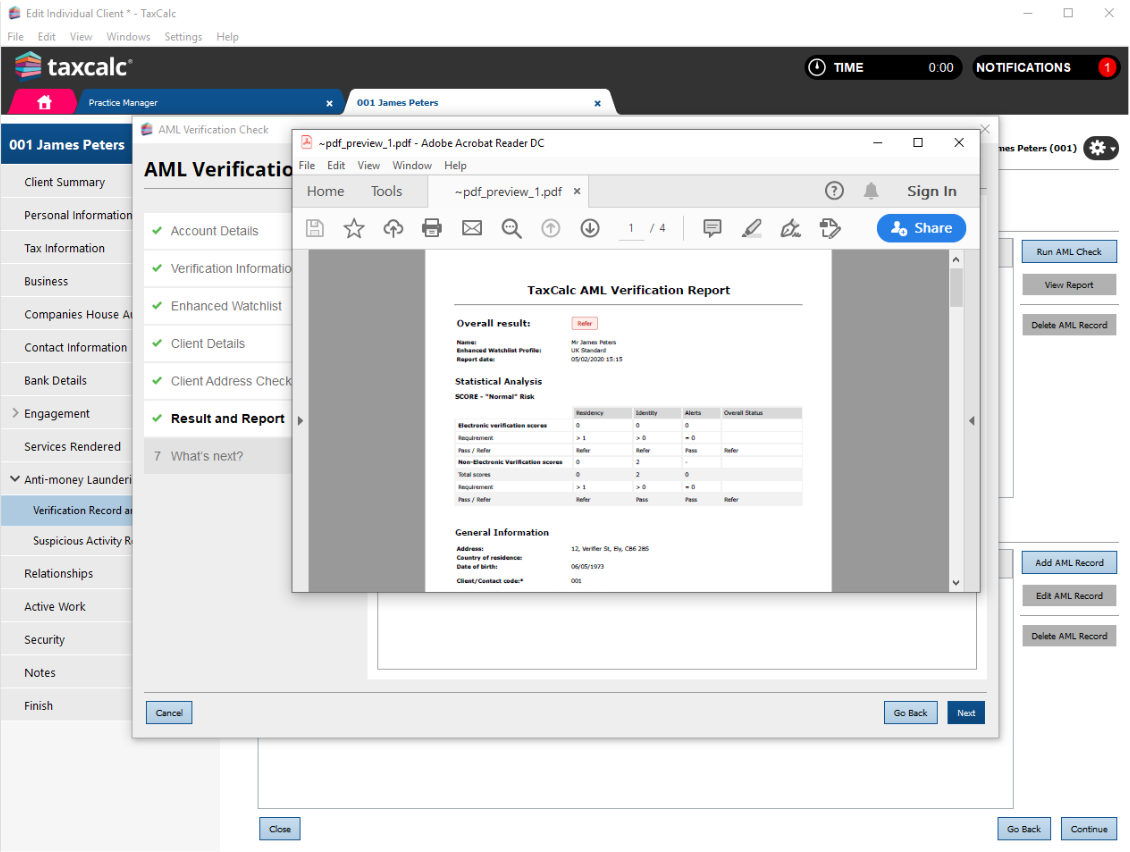

After carrying out the identity check, the system will return to you a PASS or REFER result with additional information about data sources used and results of those personal checks.

If the check returns a REFER, there are action points to give you guidance as to further enhanced due diligence that you may wish to consider

Your Anti-Money Laundering compliance

Firms are required to process their clients' data in accordance with the Data Protection Act 2018 and money laundering regulations. You will need to enter your Data Protection Registration Number when registering to use TaxCalc Anti-Money Laundering Identity Checking Service.

Your firm will also need to observe anti-money laundering compliance from either your professional body or, in the instance that you are not a member of a recognised professional body, from HM Revenue and Customs itself.

Data Protection and Equifax

Before you can begin making online searches, you will need to be registered with the Information Commissioner's Office and have your Data Protection Registration Number to hand.

Legitimate Data Protection Registration Numbers will always start with the letter Z. Sometimes firms may be issued with provisional numbers, starting with the letter P. Equifax cannot process identity searches with provisional numbers.

Registration can be done online with the Information Commissioner's Office and incurs an annual registration fee of £35.

Register with the ICOProfessional Regulation

Any finance professionals that provide services to clients and who are not regulated by a recognised professional body will be regulated by HM Revenue & Customs.

Learn moreRegistration is via a MLR100 form, which can be completed online on the gov.uk website. There is no charge for registration.

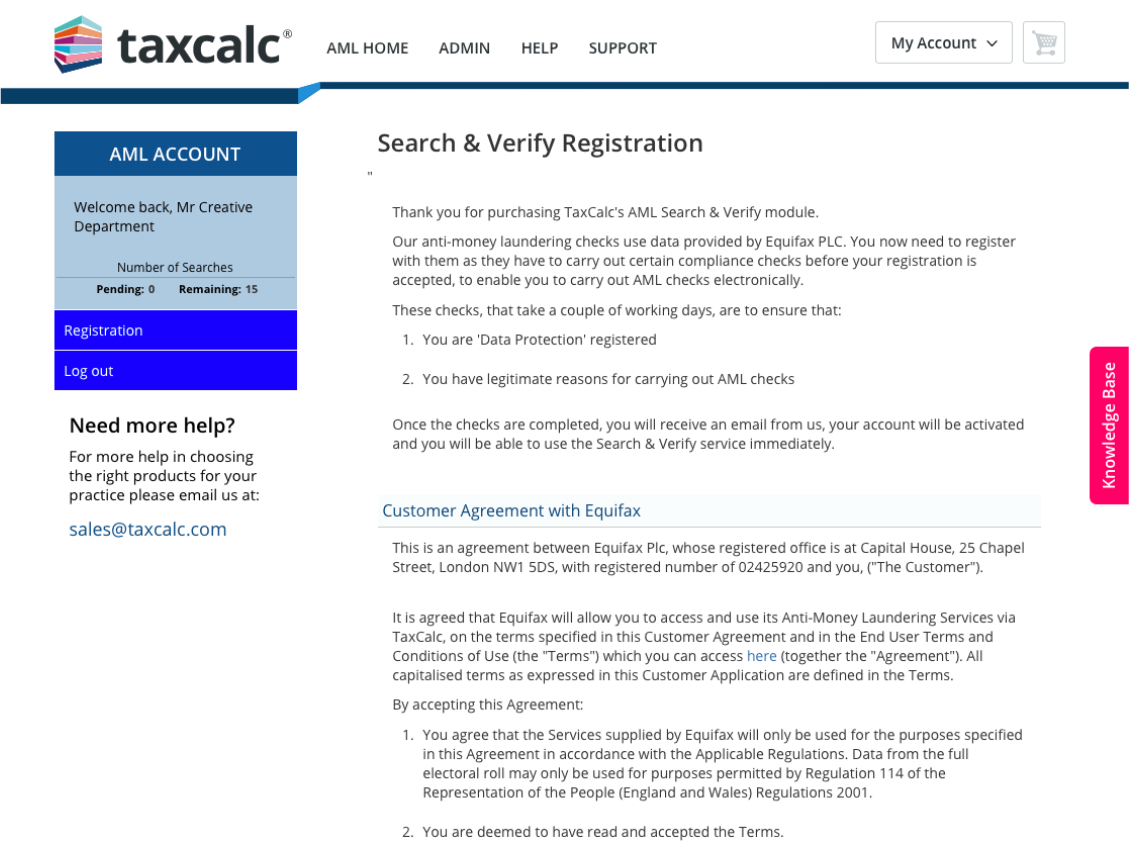

RegisterOnce purchased, you will also need to register with Equifax. Please note high volumes of applications may result in a delay with Equifax processing your application.

AML Centre

Meet your obligations under the Money Laundering Regulations which apply to your firm and clients. Perfect for accountants, bookkeepers and other finance professionals.

Simple and effective for when additional verification is required.

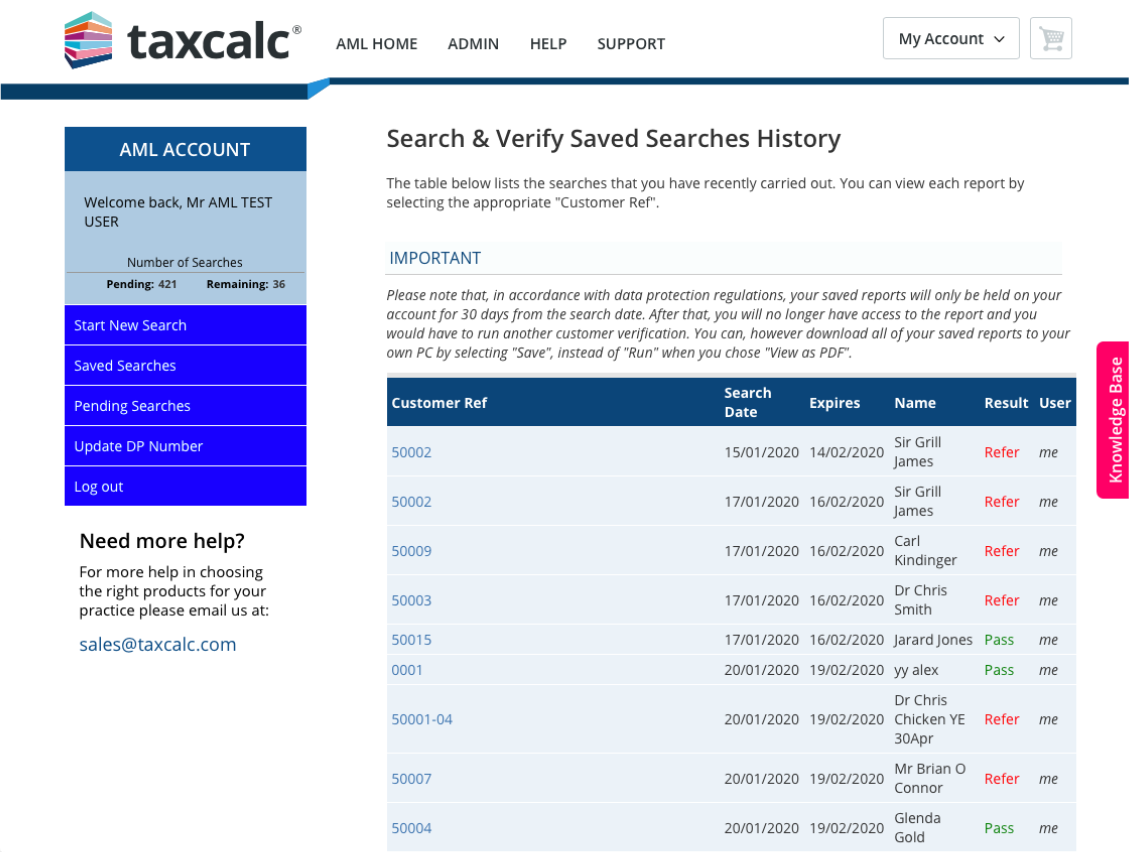

AML Identity Checking Service screenshots

Supporting your AML obligationsOnline

Registering with TaxCalc Anti-Money Laundering Identity Checking Service is easy, requiring you to fill out an online form.

Carrying out a search online is as simple as entering as much relevant data about your prospective client as possible.

The system uses data held by Equifax to provide a PASS or REFER on your client's identity.

The report is held online for download for 30 days.

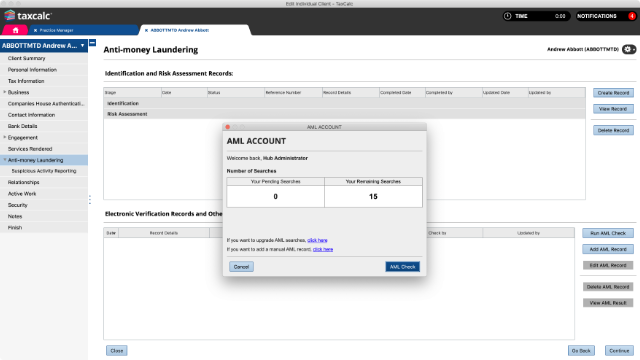

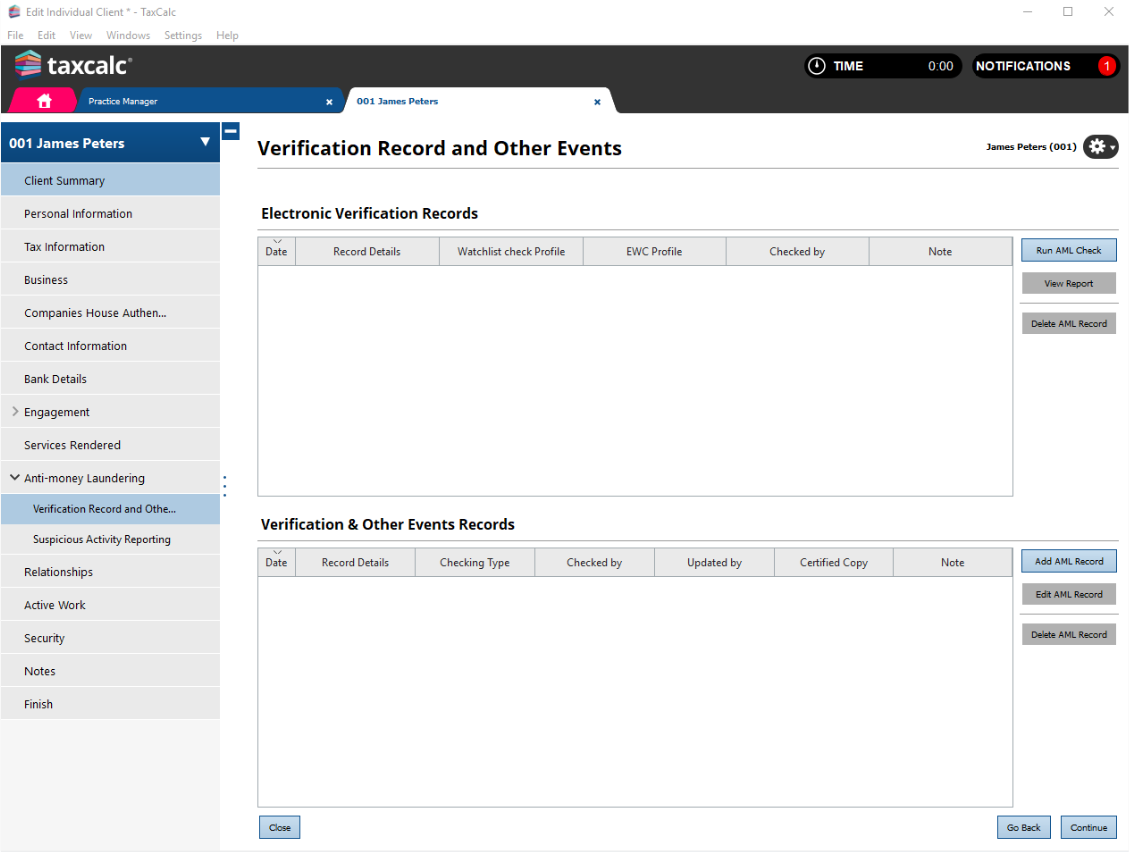

Within TaxCalc

You can carry out AML searches from your client record from within Practice Manager.

Enter the specific details and send to Equifax without logging into our website

View the AML Report directly from Practice Manager once the AML Search is completed.

Frequently asked questions

The questions below provide answers to many aspects of

TaxCalc Anti-Money Laundering Identity Checking Service.

If you'd like to know more, please call us on 0345 5190 883 or email sales@taxcalc.com.

How do I register for the Anti Money Laundering (AML) service?

You must register with the Information Commissioners Office (ICO) as a Data Controller in order to be assigned a Data Protection Number (DPA).

Equifax, our third party service provider, will then check that you are who you say you are. Please note that high volumes of applications may result in a delay with Equifax processing your application. Please see our KnowledgeBase article for more information.

Why do I need to pay to register for this service?

Unfortunately, it is not possible to completely automate the registration process and the charge covers a small amount of manual processing undertaken by Equifax.

Do search credits last forever?

No. There will be a 12 month expiry from the date of purchase.

Can I have a credit for unused searches?

No. Once you have bought search credits, they are not refundable.

How long do you keep the results of searches?

Our system will hold the report for 30 days. After that, it will be irretrievably deleted.

Can I buy more search credits before I've used up my current batch?

Yes. If you are running low on search credits, you can buy more to top up your allowance.

What should I do if the system returns a REFER result?

A REFER result means that not enough information was found to corroborate your client's identity or negative information was found that will require you to consider additional factors.

Can I use the system to perform a credit check on my client?

No. The system will only confirm your client's identity and will not return any information about their credit score.

Are there any prerequisites to running an AML Identity Check?

Yes, the minimum data required to run an AML Identity Check is the surname, forename, date of birth and a UK residential address.

Will using the system affect my client's credit rating?

No. Whilst Equifax will record the fact that a search was made to corroborate your client's identity, this will not affect their credit score.