TaxCalc Blog

News and events from TaxCalc

TaxCalc News February

HMRC Update on off-payroll (IR35) rules

Whilst a review of the IR35 implementation plans continues in the House of Lords until the end of this month, HMRC have announced changes to the draft legislation.

HMRC has confirmed that the new rules for contractors, working for medium and large-sized companies, will affect services provided after 6 April 2020 and will not be applied retrospectively regardless of payments made after this date. Where the services are performed by the contractor before 6 April 2020 it will continue to be the responsibility of the contractor and their personal service company (PSC) to decide if the work falls within IR35 and pay the right amount of tax to HMRC.

There is guidance from HMRC for contractors on the changes to off-payroll working rules (IR35)![]() and the draft legislation can be found in the Employment Status Manual (ESM10000) onwards.

and the draft legislation can be found in the Employment Status Manual (ESM10000) onwards.![]()

MTD for VAT – the end of the ‘soft landing period’

As per VAT Notice 700/22![]() the soft landing period for digital links is coming to an end.

the soft landing period for digital links is coming to an end.

For VAT return periods beginning on or after 1 April 2020 (1 October 2020 for deferred businesses), digital links between the VAT return figures submitted and the VAT transactions supporting those figures will be required. This means that HMRC may require evidence of totals calculated automatically via formulas and linked cells in a spreadsheet, for example.

Even after the ‘soft landing period’ has ended, our VAT Filer bridging software has met HMRC’s requirements for being listed on their software supplier list and continues to be compliant. VAT Filer provides an incoming digital link, by allowing businesses to import data held in a spreadsheet into the nine VAT Return boxes. From there, the information is sent digitally, via APIs, to HMRC’s MTD system. TaxCalc also provides for the ability for post-import adjustments to cater for items such as partial exemption and the margin scheme.

TaxCalc Top Tip:

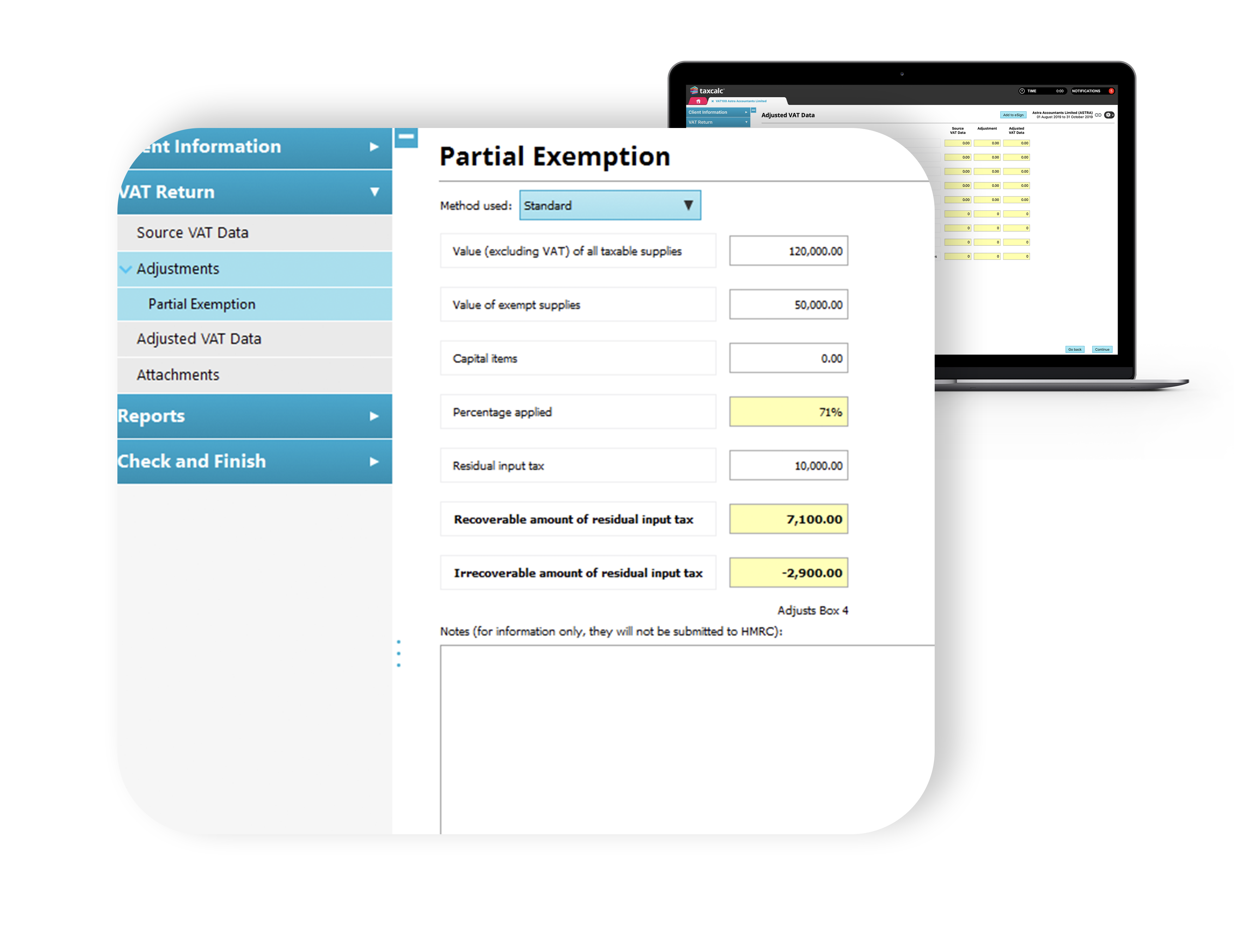

VAT Filer > Adjustments > Partial Exemption

Did you know that VAT Filer can calculate Partial Exemption adjustments?

By entering your standard and exempt sales supplies, the system will calculate a percentage to apply to the amount of residual input tax entered. The adjustment provided for input tax is clearly reported and can be easily tracked for audit trail purposes.

Tax: Check self-employed National

Insurance contributions

Following on from the ‘Other Support’ section of HMRC’s Self-Assessment Edition of the Agent Update![]() , if your clients receive a revised assessment of tax due for 2018/19, which includes an adjustment for reducing or eliminating class 2 and/or class 4 National Insurance contributions (NIC), it may be incorrect. This could occur if the individual is not set-up on HMRC’s self-employed database and therefore their system is not expecting to collect class 2/4 NIC.

, if your clients receive a revised assessment of tax due for 2018/19, which includes an adjustment for reducing or eliminating class 2 and/or class 4 National Insurance contributions (NIC), it may be incorrect. This could occur if the individual is not set-up on HMRC’s self-employed database and therefore their system is not expecting to collect class 2/4 NIC.

The impact of missing periods of paying contributions is obviously a concern for self-employed individuals who may be at risk of having a reduced pension pot. If your clients are at risk of having gaps in qualifying years, they can check their National Insurance record![]() on the Gov.uk website.

on the Gov.uk website.

HMRC looking for help to trial Report and Pay for CGT

From 6 April 2020 HMRC will require UK individuals to report and pay Capital Gains Tax (CGT) on the disposals of UK residential property (other than a principle private residence). The tax due must be reported and paid to HMRC within 30 days of completion of the disposal.

HMRC is developing a new digital service accessible from GOV.UK, which will be available from April 2020 to make it easier for customers to report and pay their CGT property disposal liability. They are recruiting agents and their clients to test the system in advance of the start date. The testing will include setting up the client’s CGT account and authorising the agent in the live system, but not the reporting of transactions.

If you represent UK and non-UK resident individuals or trusts who are likely to need to report CGT on UK property for a client after 6 April 2020, you could take part in the trial and provide valuable feedback.

To join, email:ddcw-info-cgtpd-g@digital.hmrc.gov.uk

HMRC’s Agent Update![]() has more information on CGT for property disposals and joining the trial.

has more information on CGT for property disposals and joining the trial.

FRC transformation into the ARGA

Last year, following the release of the Kingman report, it was decided that the Financial Reporting Council (FRC) would be replaced by a stronger regulatory body in the form of The Audit, Reporting and Governance Authority (ARGA).

After several major corporate failures, the FRC was criticised for being too slow to respond and for the time it took to complete investigations. It is hoped, with new statutory powers, the new regulator will be capable of enforcing higher audit standards.

With industry concerns that the establishment of ARGA will be delayed, the Department for Business, Enterprise and Industrial Strategy (BEIS) will give a clearer indication of its plans for ARGA by the end of March.

Upcoming Events

If you’re looking to keep up with the latest industry insights and technology then make sure you come and see TaxCalc at one of these upcoming events next month!

3-4 March

QuickBooks Connect

26 March

Digital Accountancy Show