TaxCalc Blog

News and events from TaxCalc

November news

Upcoming legislation: Ultra Low Emission Vehicles

From 6 April 2020 the car and car fuel benefit calculation is changing with the introduction of 11 new bands for ultra low emission vehicles (ULEVs) including a separate zero emissions band. This is to support the Government’s commitment to improving air quality in towns and cities. If your client’s company car has a CO2 emission figure of 1-50g/km, they will need to provide the cars zero emission mileage. This is the distance that the car can travel in miles on a single electric charge.

|

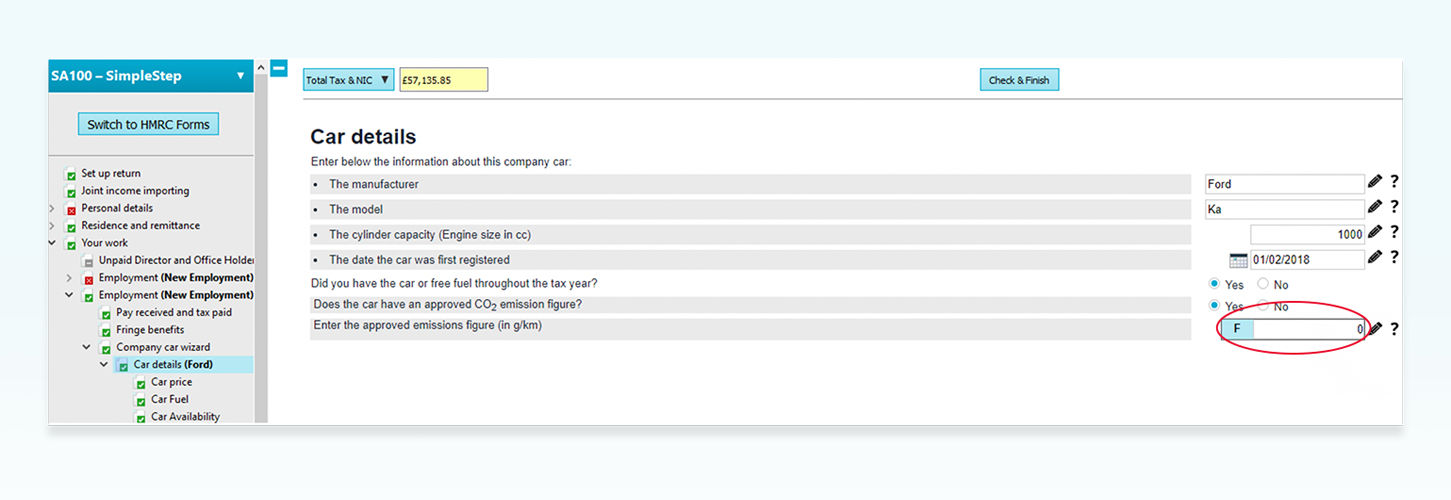

To ensure you receive the correct benefit calculation for zero emission cars: Within Company car wizard > Car details, select ‘yes’ to ‘Does the car have an approved CO2 emission figure’ and enter the approved emissions figure as zero  |

Tax: HMRC Filing Exclusions and Special Cases

As we approach the busiest filing period of the year, we thought a reminder on HMRC filing exclusions would be useful.

Exclusions are cases where HMRC’s tax calculator is unable to compute an individual’s tax liability correctly. In these situations, HMRC’s systems will either not permit the return to be filed online or will calculate the tax due incorrectly. We have been working to identify scenarios where an Exclusion has arisen and ensure that the software provides instructions on how to deal with filing.

Generally, where a return is identified as being subject to an exclusion, it can be filed on paper instead. The paper filing deadline for 2018/19 is 31 October 2019 but, provided the return is filed by 31 January 2020 and is accompanied by a reasonable excuse form explaining which exclusion case applies, HMRC should not charge a penalty.

Special Cases represent issues that HMRC have identified as requiring a workaround in order to prevent a filing rejection. Where possible, we have taken care of these workarounds within the software or have provided a message before live filing to advise how to deal with the workaround. There may be some limited scenarios where a paper return will need to be filed.

|

The list of exclusions and special cases are subject to change, so save our knowledgebase article for a regularly updated list.

|

|

The cryptoassets sector is fast-moving and developing all the time, and consequently the tax treatment continues to develop. HMRC have recently updated their advice with more detailed guidance. |

|

In brief: |

|

|

Detailed guidance can be found on tax treatment of individuals and businesses with cryptoassets. |

|

Accounting Excellence Software Awards Voting for the annual Accounting Excellence Software Awards is open! Whether you're new to TaxCalc or have trusted us to power your practice for years, we'd really appreciate your vote of confidence. |