TaxCalc Blog

News and events from TaxCalc

October news: New products, advice, MTD and more

What with all that’s going on in the world, it’s easy to get overloaded with information. So trust TaxCalc to bring you the most relevant news and updates relating to your current life in practice. Here’s our October roundup of some of the latest changes in legislation, plus pertinent product news and advice.

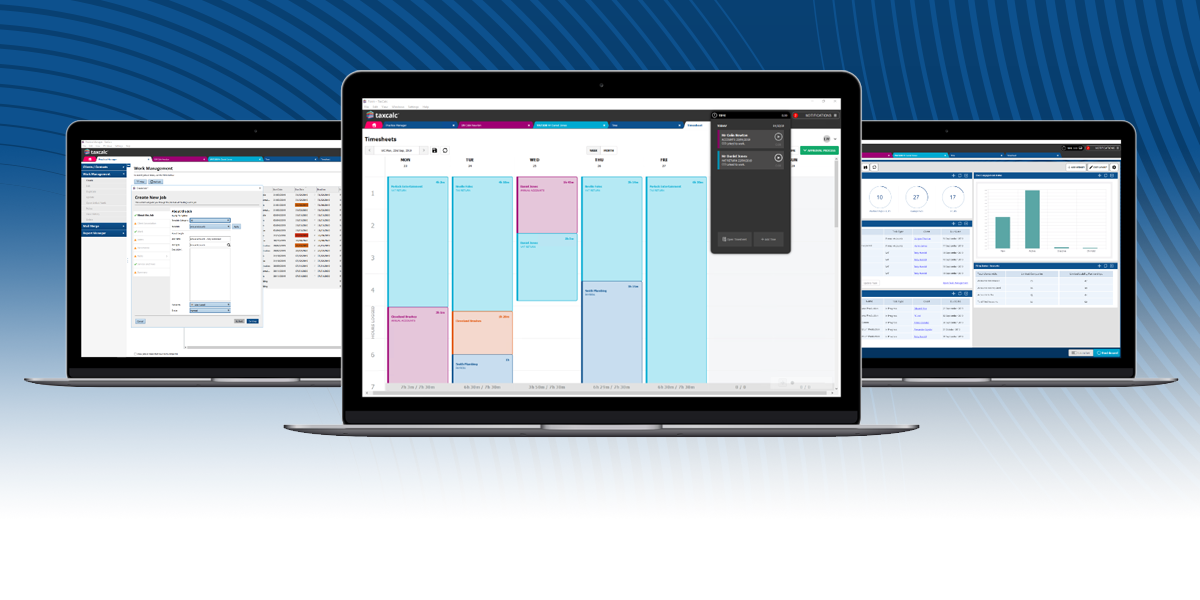

Out now. OUR new game-changing practice management toolkit

A trio of new breakthrough practice management products offering client management, advanced practice management, time-tracking and ultra-secure document management.

MTD for VAT - digital link extension period

From 1 April 2020 (or 1 October 2020 for deferred business types) business systems accounting for VAT must use digital links for any transfer or exchange of data between software programs, products or applications.

HMRC has recognised that some businesses with complex or legacy IT systems may require additional time to implement the required digital links. It’s also been highlighted that some organisations use specialist software to facilitate processes throughout their whole business and manual intervention is necessary to enable a link to accounting systems.

In these, or other specific scenarios, businesses can apply for additional time to put the required digital links in place (subject to qualifying criteria). If a business qualifies, additional time will be granted as a specific direction from HMRC.

Further details regarding digital links and how to apply for additional time can be found at section 4.2.1.3 of HMRC's VAT Notice 700/22: Making Tax Digital for VAT

TaxCalc remains fully compliant with providing digital links to import VAT data and submit via the MTD service.

|

|

Tax Tip: Claiming VAT on Purchase of Company Cars

A first-tier tax tribunal (Case TC07313) has ruled that input tax could be claimed on three new cars acquired by a business, as long as they were used exclusively for business purposes by the business owner, their spouse and children. The key factors in determining the outcome were:

- The individuals using the company cars all owned separate cars, which they used for private use.

- The keys of the business cars were kept in a locked safe.

- Mileage logs were kept for business trips.

- There was a contract in place to forbid private use of the cars.

Changes to Private Residence Relief (PRR)

There is currently a policy paper on changes to PRR to apply to disposals on or after 6 April 2020, which includes:

- Reduction of the final period exemption from 18 months to nine months (although the special cases in which the 36-month period applies remain unchanged); and

- Restriction of lettings relief to situations where both the homeowner and their tenant are occupying the dwelling at the same time. There are no transitional measures proposed, so this will effectively remove lettings relief retrospectively.

The consultation on these points (and other proposed changes to PRR) closed on 5 September 2019. The AAT article, PRR: how will your clients be affected, provides some interesting analysis.

MTD for VAT: Agent Services Account

New additions to the ASA now mean that:

- Agents are now able to track the status of any requests that they’ve made to authorise new clients in the last 30 days in the ASA.

- Agents have to enter their AML supervisory details when they create an ASA. HMRC has updated the process to allow agents to create an ASA whilst having a pending AMLS application.

|

|

Domestic Reverse Charge

Recently we provided information regarding the new Domestic Reverse Charge (DRC), which was to be introduced from 1 October 2019. HMRC has updated its policy paper with the following: “To help these businesses and give them more time to prepare, the introduction of the reverse charge has been delayed for a period of 12 months until 1 October 2020. This will also avoid the changes coinciding with Brexit.

Interested in learning more about what TaxCalc can do for your practice? Get in touch.

0345 5190 883

sales@taxcalc.com