Getting started with Self Assessment

Learn how to complete your tax return using TaxCalc with our quick-fix videos.

1. HOW TO DOWNLOAD TAXCALC

Download and install TaxCalc

2. HOW TO UPDATE TAXCALC

Updating TaxCalc to the latest version

3. FILE YOUR RETURN

Filing your tax return online

4. IMPORTING A TAX RETURN

Bring data from a previous return into this year

5. IMPORT MULTIPLE TAX RETURNS

Import multiple returns from last year

6. CREATING PDF COPY

How to make a printable copy of your tax return

7. AMEND A TAX RETURN

Make changes to your tax return if you've already filed online

8. LOCATE A MISSING TAX RETURN

How to find a tax return if yours is missing

How to complete your tax return with TaxCalc

There are many reasons why you may need to complete a tax return. If, for example, you are Self Employed and earned over £1,000 or are a Partner in a business partnership.

To find out if you need to complete a tax return, please see the Tax Return Checker tool on HMRC's website.

There's also a link to the HMRC Child Benefit tax calculator to check your Child Benefit tax status.

For further information on Self Assessment scenarios go to the Frequently Asked Questions section of this guide.

We're an award-winning, HMRC recognised software provider. Tens of thousands of people like you trust us to file their returns online every year.

TaxCalc is known for being the simplest way to file your return. Our unique SimpleStep® asks questions and then takes you to the relevant section of your return.

You don't need any previous experience just some paperwork, a cup of tea and half an hour!

We pride ourselves on our UK-based free telephone and email support. Coming up to deadline day, 31st January , we offer extended support hours for our customers.

Please note: it may take up to a week to receive your details from HMRC. Don't leave it to the last minute!

Before you can complete a Self Assessment tax return, you'll need to be registered with HMRC to inform them that a tax return is required. You can register with HMRC using one of the following methods:

Register Online – follow the links at www.gov.uk/register-for-self-assessment to complete online registration.

Register by Phone – contact 0300 200 3310.

Register by Post – download and complete form SA1 and post to your local tax office.

To complete your registration by any of these methods you’ll need:

- National Insurance Number

- Your personal details

- Any details of your business or change of circumstances which mean you need to complete a return

To file online, you'll also need to register with HMRC Online Services. To do this, you'll need your Unique Tax Reference Number and your National Insurance Number or postcode.

Once you have this information, you can go to HMRC's Registration page and follow the relevant instructions to complete your registration for online services.

When you've completed the registration, HMRC will send you an Activation Code with instructions for activating your account. Once activated, you will receive your HMRC User ID and password.

You're now fully registered and can complete and submit your tax return online.

The deadline to file your Self Assessment tax return online to HMRC for the tax year is 31st January.

Try not to leave it to the last minute!

Paying tax through your tax code

If you owe up to £3,000 of tax to HMRC and are a PAYE employee, it's important to file on or before 30 December 2020 to avoid having to pay any tax you owe in one lump sum.

Your tax code will be adjusted and any money you owe will be deducted from your salary each month over the following 12 months.

Our SimpleStep® process will guide you through your tax return and ask for relevant information based on your answers.

If you want to make the process as efficient and simple as possible, it's always best to be prepared and have everything to hand before you start completing your tax return. If you're unsure, don't panic. You can always save your progress, find the required paperwork and return to enter any outstanding information.

Here are the most common things you may be asked for:

Employment income

- P60 or P45 showing your taxable income and tax deducted for the year.

- P11D showing benefits and expenses (if you receive any).

- Details of any other business expenses not reimbursed by your company (professional subscriptions, mileage, etc).

Partnership income

Details of income received from Partnerships. You should receive a Partnership Statement that declares the income you should enter into your tax return.

Interest & dividends

Statements of interest received and tax deducted from your banks, building societies and other savings investments.

Dividend vouchers received from shareholdings, showing the income received.

Rental income

If you let a property (or multiple properties), or part of your own home (rent a room), you'll need to obtain all information in relation to income and relevant expenditure on these properties.Foreign income

If you receive any income from overseas, you'll need details of this – for example, foreign dividends and bank interest.Pension contributions and Gift Aid Donations

Details of all contributions into pension schemes and details of any Gift Aid donations.Income from private pensions

Pension providers should provide a P60 at the end of the year, showing Taxable Income and Tax Deducted.State pension

HMRC will not provide a P60 but you simply need to calculate what your annual entitlement was for the year.Capital Gains

If you have disposed of any assets such as property or shares, you should have details of purchase prices and disposal proceeds.TaxCalc provides two products, TaxCalc Trust Solo and Trust Duo, for anyone who needs to complete one or two Trust tax returns.

TaxCalc offers a separate range of products to cater for different types of business tax returns, whether you need to submit a Corporate Tax return or a Partnership return.

Step 1

Choose the year you need to complete a Self Assessment tax return for, by clicking on the relevant icon.

Step 2

Once within your chosen tax year, click on the Create New SA100 button (SA100 is your tax return).

This will open up a new Self Assessment return.

Step 3

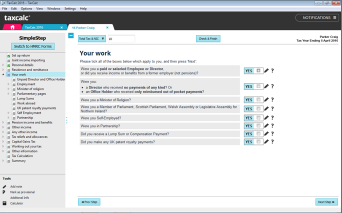

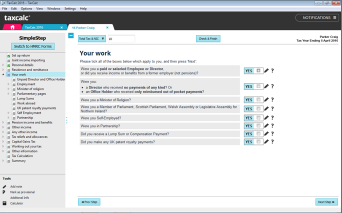

Choose SimpleStep® questionnaire mode to enter your data into your return. Navigating the Self Assessment return is easy. Simply use the Next Step and Previous Step buttons to move through your return.

SimpleStep® works by only revealing to you the parts of the tax return you need to complete, based on the answers to questions it asks you. This means that most people can ignore large parts of the tax return and focus on the parts they need to complete.

Step 4

The first details you'll be asked for are your personal details and tax details, such as your National Insurance Number and your Unique Taxpayer Reference (UTR), both of which are usually shown on any letter from HMRC.

Step 5

As you work your way through SimpleStep®, TaxCalc is completing your return in the background. TaxCalc handles all the calculations for you. Once you've completed your return, our unique Check & Finish error checker validates the entries in your return.

Check & Finish is great because it's like a second pair of eyes. If anything requires your attention, Check & Finish will tell you, suggest a solution and take you to where the problem lies.

Step 6

Filing your tax return is easy! TaxCalc will guide you through the process; simply follow the onscreen instructions.

Frequently Asked Questions

-

NON-RESIDENT TAX RETURN

-

Q.

Despite being Non-Resident in the UK, HMRC has requested

I submit a UK tax return in relation to my UK property which

is being rented out. However, they have said that I can't use

their online service to file my tax return. Will TaxCalc be able

to do this? -

A.

Yes! TaxCalc provides the SA109 ‘Residence, remittance basis

etc.’ supplementary pages that require completion as a non-

resident taxpayer in the UK. All supplementary pages are

completed by following our Q&A SimpleStep method in the

program. -

SELF-EMPLOYED CAPITAL ALLOWANCES

-

Q.

I'm self-employed and have purchased multiple assets in the

year, including a vehicle and machinery for use in my

business activities. I understand that I'm supposed to claim

Capital Allowances in relation to these purchases, but am

unsure what Capital Allowances are. Will TaxCalc help me? -

A.

TaxCalc software provides a Capital Allowance wizard to

assist you in making your claims for Capital Allowances. All

you need to do is enter the asset details such as cost and

dates of purchase. TaxCalc will calculate the relevant

allowances and input the information into the required

boxes on your tax return. -

CAPITAL GAINS TAX – ENTREPRENEURS RELIEF

-

Q.

I've sold shares which qualify for Entrepreneurs' Relief, will

TaxCalc perform the relevant calculations for me? -

A.

When using our SimpleStep method, just enter your asset

details and TaxCalc will then calculate the relevant gain or

loss. It will also assist you in claiming reliefs such as

Entrepreneurs' Relief. If the selection for Entrepreneurs'

Relief is made, TaxCalc will generate the relevant

computations to attach to the tax return and perform the

tax calculation at the relevant rates.

-

MINISTER OF RELIGION

-

Q.

I hold a post as a Minister of Religion so need to complete a

tax return. HMRC has said I'll need to purchase third party

software to file my tax return online as their own offering

does not provide the relevant sections for me. Does

TaxCalc have the necessary sections for me to complete my

tax return online? -

A.

Yes! The supplementary pages SA102M ‘Ministers of religion’

are included with the product, so completing your tax return

in our software won't be a problem. -

TRUSTS INCOME

-

Q.

I've received a payment of discretionary income from a UK

resident Trust. Can I file my tax return using TaxCalc? -

A.

Yes! Unlike the HMRC Online Services, TaxCalc software

provides the supplementary pages SA107 ‘Trusts etc.’ that

this income will need to be declared on. -

FOREIGN TAX CREDIT RELIEF

-

Q.

I have foreign bank interest that's been taxed in a foreign

country. I understand I may not be able to claim all of the

foreign interest suffered against my UK tax liability due to

Double Taxation Treaties. Will TaxCalc assist in what

amounts I can claim? -

A.

. TaxCalc automatically performs Foreign Tax Credit Relief

calculations and restricts the foreign tax paid amount to the

relevant figures based on the current Double Taxation Treaty

agreements. You don't need to worry about performing the

difficult calculations prior to entering your income and tax

deductions. We'll do it all for you. Just provide the data! -

MULTIPLE SOURCES OF INCOME

-

Q.

I have multiple sources of income, including employment

income from property lettings. I'm also a member of a

Partnership. Will your standard product be suitable for my

needs? -

A.

Yes! All of our tax products contain all of the available

supplementary pages, so you can submit multiple sources of

income without incurring any additional fees. Our products

will cater for all sources of income you need to declare on

your Self Assessment tax return.

Troubleshoot common issues

If you encounter an issue when using TaxCalc check out our Knowledge Base

or these common questions below.

OpenGL error

TaxCalc crashes during installation, or when updating with an error of 'Failed to create OpenGL'.

1046 error

When attempting to file you may get a 1046 error if your username/password are not recognised.

Changing a filed return

If you need to make changes to a filed return follow these steps.

Can't print documents or create a PDF

This could be due to a problem with the installation or configuration of the default PDF reader.

Super affordable software from the Digital Tax People.

With prices starting at just £38.00, TaxCalc simply ticks all the boxes.

Windows 7+, Mac and Linux

System requirementsNeed help from our support team?

Throughout the year our award-winning support team usually answer calls within 60 seconds,

though this may be slightly longer in January. We usually respond to emails within 1 working day.