Partnership

From £80

You can buy TaxCalc Partnership Tax Return software today for just £80.00 + VAT

Make light work of your partnership tax return

With a heritage dating back nearly 30 years, TaxCalc has been trusted by hundreds of thousands of tax paying partnerships to help them with their tax return. Whether you know your way around the returns or need a helping hand, TaxCalc software provides you with both HMRC Forms and SimpleStep® questionnaire methods of entry.

And when it comes to calculating the figures that go into the boxes, TaxCalc's numerous accountancy process wizards and tax return worksheets will help you make the correct choices and pay the right amount of tax.

Tax return experts for partnerships you can trust

TaxCalc Partnership is based upon the same core technology as our award-winning software for Practices, which are used by thousands of firms of accountants up and down the country to accurately calculate tax returns.

TaxCalc's support team is staffed by tax professionals who are on hand to help you fill out your forms. We are so confident in our Partnership tax return software that there is no additional charge for support. Our lines are open from 9:30am to 5:00pm Monday to Friday.

Individual and Partnership

returns included

TaxCalc Partnership provides the partnership, the partners, and their family members the correct tax returns for their affairs, complete with all necessary supplementary pages.

Partnership software updated & ready for 2024-25

We work closely with HMRC to ensure that your Partnership tax return software is always up to date.

TaxCalc Partnership has been fully updated to cater for the 2024-25 tax year for Self Assessment.

Previous tax years available

If you need to complete a tax return for

an earlier tax year, we stock products to

buy and download that are suitable for

tax years dating back as far as 2019ßß.

31 October Deadline for tax returns by paper

If you wish to file your return by paper,

make sure your return reaches

HMRC by 31 October or face a £100

penalty per return.

Paying your partnership tax return through your PAYE code

If you owe up to £3,000 of tax to HMRC to avoid having to pay any tax you owe in one lump sum. Your tax code will be adjusted and any money you owe will be deducted from your salary each month over the following 12 months

31 January - Ultimate deadline for online filing

If you need to complete a tax return and miss the paper filing deadline, you must

file your partnership and individual tax returns by 31 January to avoid penalties.

Fully comprehensive, yet easy to use tax return software

TaxCalc Partnership software is the simplest and most complete way to file your tax returns online.Individual and Partnership returns included

TaxCalc Partnership provides the correct forms and supplementary pages to complete tax returns for everyone associated with the partnership.

Easy to complete

Fill out your return directly using HMRC Forms mode or let TaxCalc help you with our unique SimpleStep questionnaire mode, transforming any complex accountancy work into an easy to follow process.

Check before you file

Use our Partnership software Check & Finish tools to validate your entries and address any potential problems before you file your tax return.

Share data between returns

Link and import data from the SA800 Partnership return with the partners' own SA100 Individual returns.

Other useful forms

TaxCalc Partnership tax return software includes some other handy forms such as the R40 Repayment form and the SA303 Reduction of Payments on Account.

Expandable and upgradeable software

TaxCalc Partnership can be upgraded with additional Individual, Partnership, Corporation Tax and Trust forms.

Please call 0345 5190 882 to discuss your requirements.

Features in detail

TaxCalc Partnership provides you with all the featuresand functions to make light work of your tax return.

At a glance

- SimpleStep questionnaire mode for guided completion of your tax return

- Facsimile HMRC Forms mode for direct entry of your tax return

- Check & Finish routine to validate entries in your tax return

- All supplementary pages including Non-Residence, Lloyd's, Trusts and Ministers of Religion

- Import data from the Partnership return into the Individual returns

- Import data from earlier years

- Detailed calculations and repayment summaries

- Export reports to PDF, Microsoft Word and Microsoft Excel

- On-the-fly tax liability calculation

- Password protection your returns

- Automatic selection of long or short versions of forms

- Share data between spouses

- Auto-save function

- Context-sensitive help

- Full HMRC Forms and tax guidance help manual

- Unlimited email and telephone support

- Anonymous "send return to TaxCalc" function to get help from our Support team

Wizards to help you with:

- Company car, fuel benefit and mileage claims

- Employment expense deductions

- Capital allowances

- Basis periods

- Class 2 national insurance

- Capital gains calculations (with preparation of calculations schedules)

- Foreign tax credit relief calculations

- Lump sum receipts

- Property wear and tear allowances

- Interest and dividend analysis worksheets

Accessorise your TaxCalc

TaxCalc sports a number of helpful add-ons. You can choose one or more add-on modules

and review pricing when you come to buy your software.

Additional SA900 Trust tax return

If you have a Trust and need to file a single SA900 Trust tax return, this add-on provides you with the form for easy on-screen completion and online filing.

Income received from the Trust can be imported directly into the SA100 Individual tax return.

£43.33 + VAT

TaxCalc Dividend Database (2024-25 year)

Make the entry of dividend data a snap with this database of FTSE 350 and AIM 100 listed dividend data for the 2024-25 tax year Bring forward your shareholdings from your 2022-23 tax return and TaxCalc Dividend Database will do the rest.

The database is released in June each year to include dividends paid up to the end of the previous tax year.

£6.25 + VAT

TaxCalc What If? Planner

Use your 2024-25 tax return data to project your tax liability for the 2024-25 tax year. You can also create scenarios, adjusting your levels of income or to see the effects of decisions being made now on next year's tax bill.

Applies to SA100 tax returns only.

The add-on is released in June each year to include changes announced for the next tax year.

£12.50 + VAT

TaxCalc in action

We pride ourselves on delivering high quality and easy to use software. Please click on a screenshot below tosee how you use TaxCalc and see how easy it is to complete your tax return.

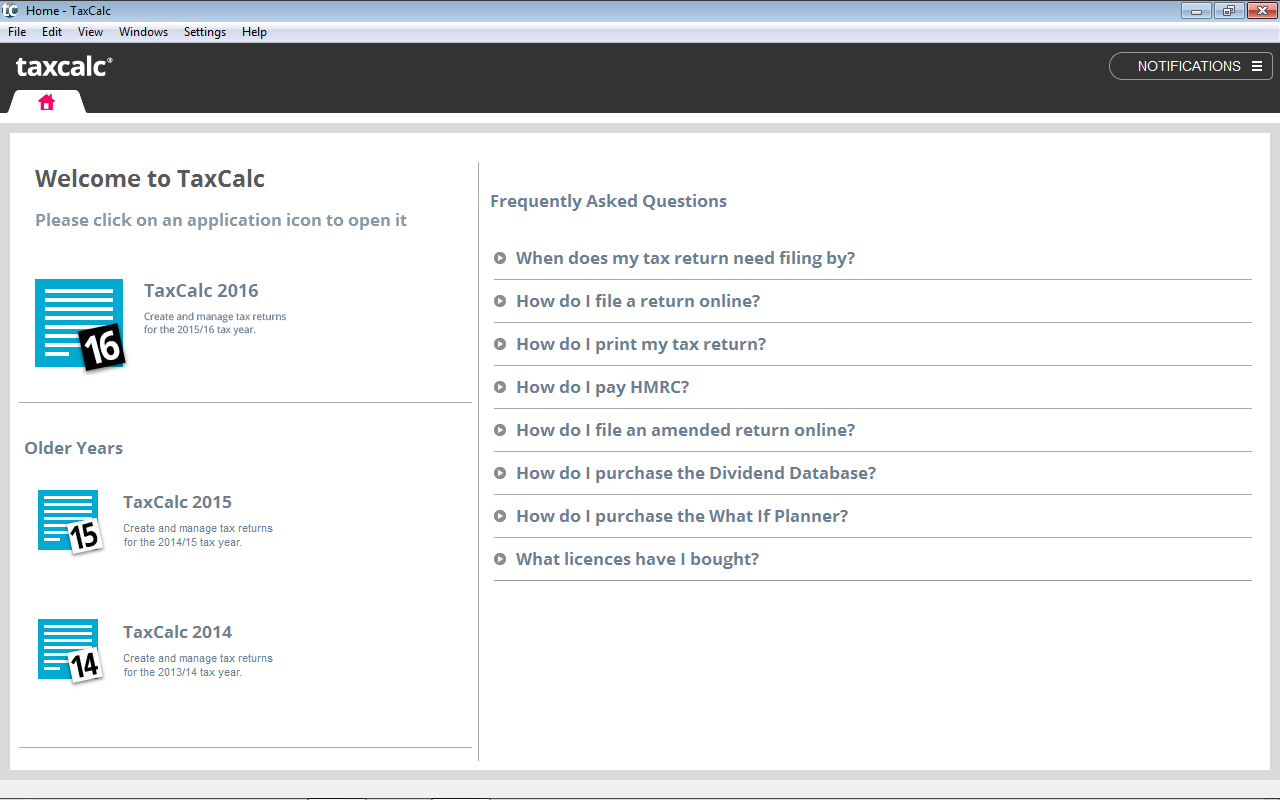

TaxCalc organises and provides access to tax returns for the 2024-25 back to 2018-19 tax years*.

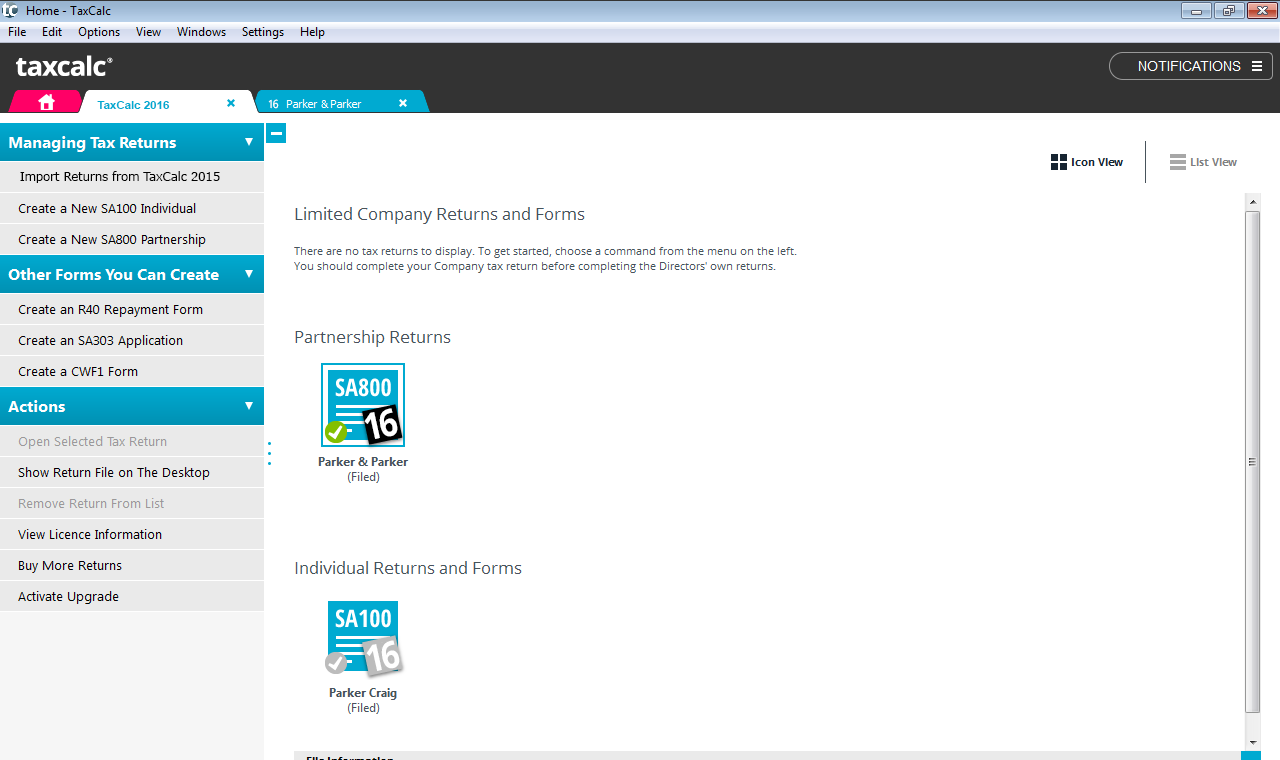

TaxCalc manages the production and progress of your tax returns, together with additional supporting forms.

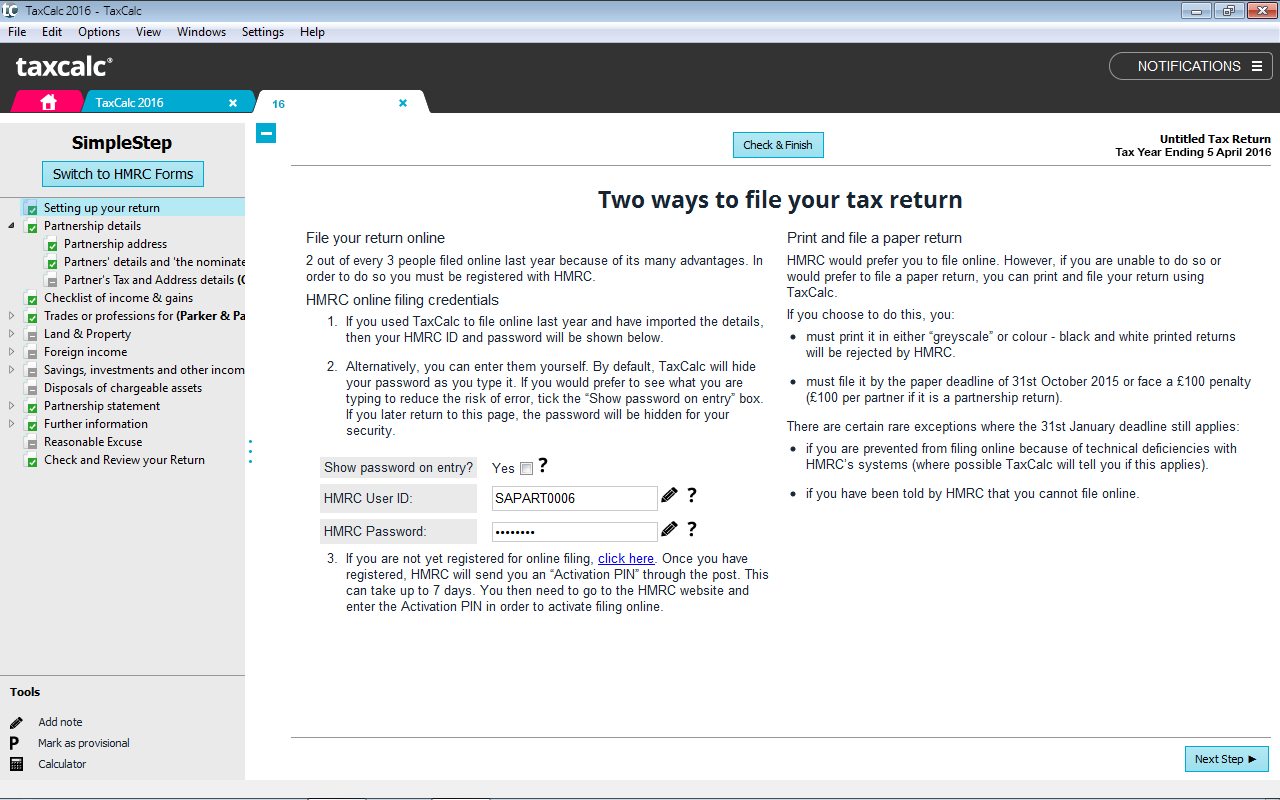

TaxCalc contains two modes of entry. SimpleStep is our unique questionnaire mode, which guides you through the return, asking questions based upon answers given and data entered.

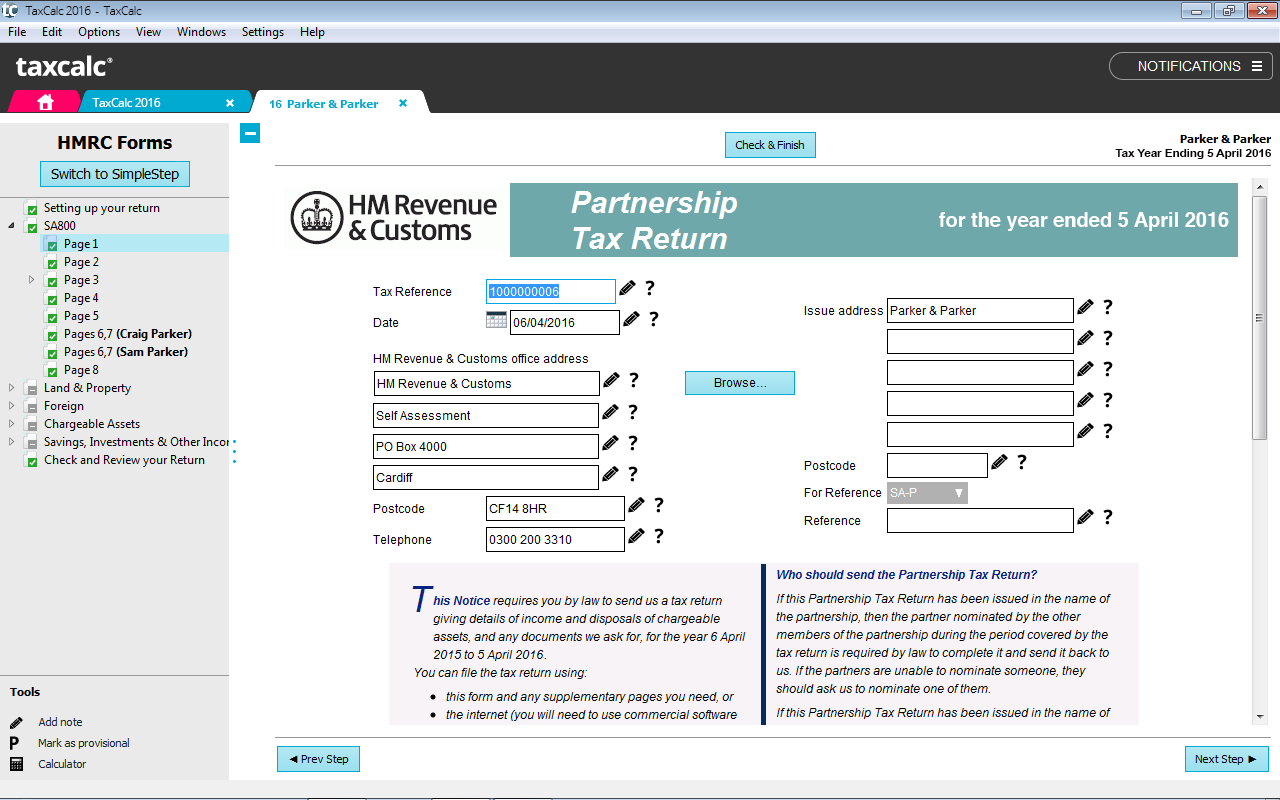

HMRC Forms mode displays a facsimile form for fast direct entry.

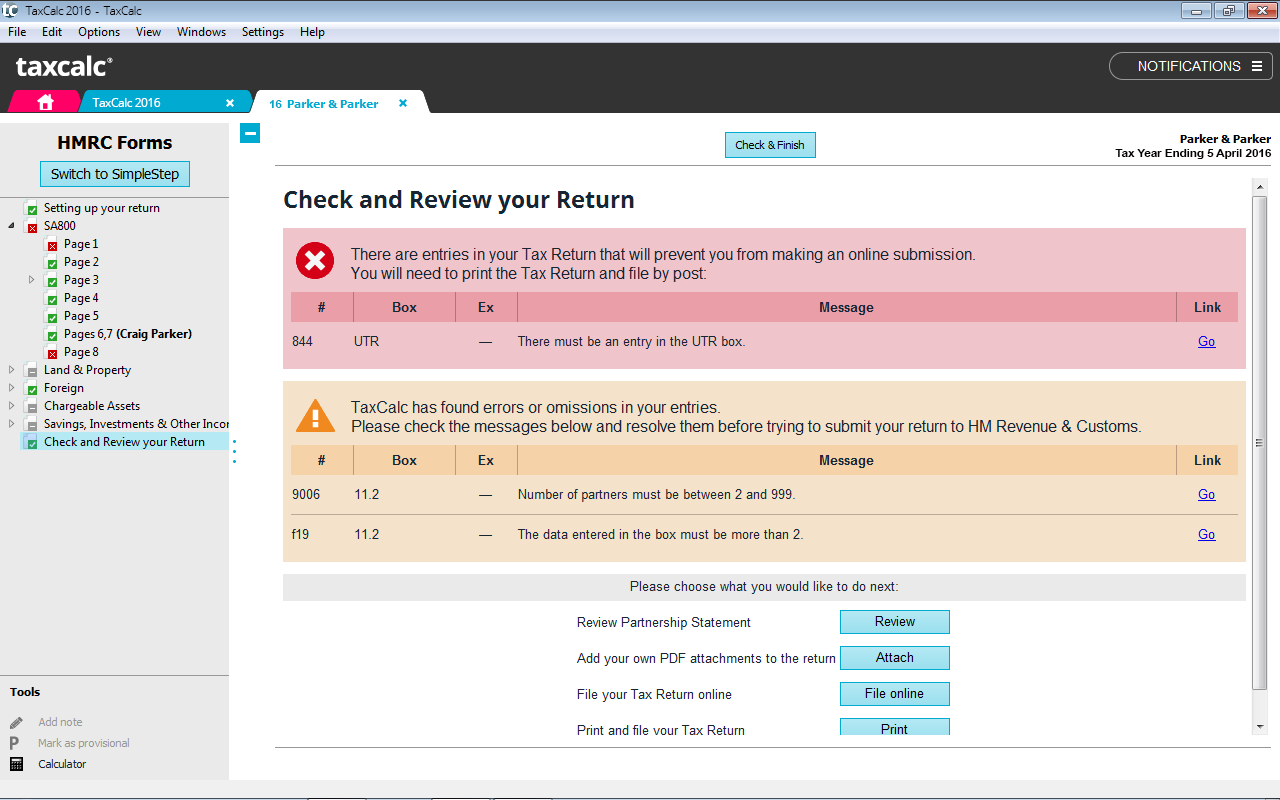

When you get to the end of your return, Check and Finish validates the entries you've made and highlights any potential issues before you file.

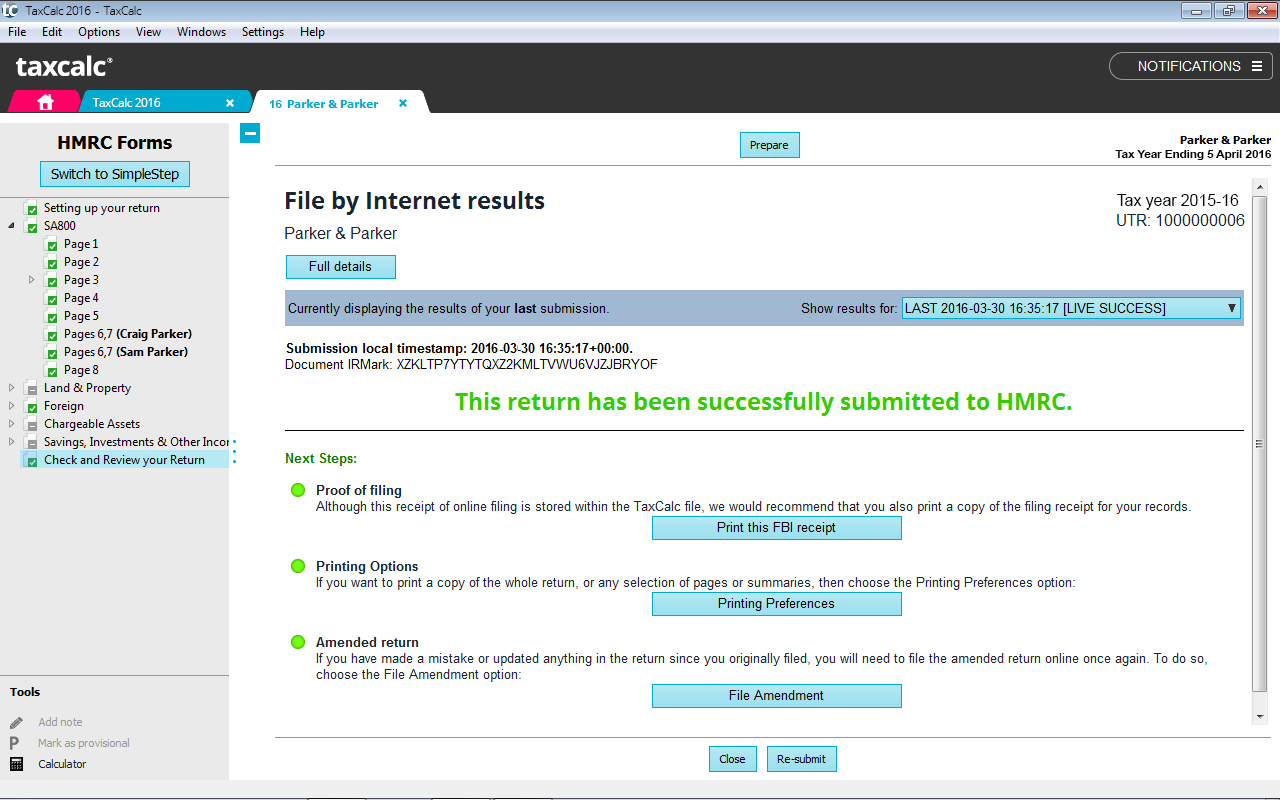

TaxCalc files online and tells you when your return has been successfully received by HMRC.

*TaxCalc is sold according to tax years, each of which is bought separately. Please see our Versions and Prices for more info.

Frequently asked questions

The questions below provide immediate answers to many aspects of TaxCalc Partnership.If you have any further questions, please call 0345 5190 882 or email sales@taxcalc.com

Does TaxCalc work on

Windows 10?

Yes. TaxCalc's software has been fully tested with Microsoft's latest operating system and we can confirm that it does indeed work with Microsoft Windows 10. For a full compatibility list please see the System Requirements for TaxCalc.

Does TaxCalc work on Apple Macs?

Yes. TaxCalc will run on any 64-bit Macintosh running Mac OS 10.12 or higher.

Does TaxCalc work on Linux

Yes. TaxCalc will run on any 64 bit kernel 3.10 (or higher), Debian (e.g. Ubuntu) or Redhat based distributions.

Do I have to buy the software every year?

TaxCalc is an annual purchase because we have to redevelop it each year to new rates and tax rules. Your licence is perpetual and will continue to provide future access to unused returns for purchased tax years.

Since TaxCalc is an all-in-one application, when you buy next year's licence, all you need to do is open TaxCalc and it will update itself to add in the 2024-25 forms.

Can I upgrade or add additional returns?

Yes. TaxCalc Partnership can be upgraded with additional Individual, Partnership, Corporation Tax and Trust forms.

To discuss your requirements, please call us on 0345 5190 883 or email sales@taxcalc.com.

Can I share licences with friends or family if I purchase a personal product?

It is not possible to share/transfer licences to friends or family as this is solely for the use of the licence holder to complete all six returns. Any shared licences would be a breach of contract under our End User Licence Agreement (EULA) and could result in termination of contract.

Can I buy previous years' returns?

Yes. We supply tax software dating back to the 2018-19 tax year. You can find this on the Versions and Prices page.

How many computers can

I install TaxCalc Partnership onto?

For your convenience, TaxCalc Partnership may be installed on up to two computers.