WorkFlow Accountancy workflow management

From £64 per year

The workflow management solution

that puts you in control

Want to work smarter, faster, be more organised and in complete control?

Integrating with your TaxCalc suite, WorkFlow is the solution for managing all activities in your practice. With automation, SimpleStep® checklists, deadline and task management, you’ll banish bottlenecks, identify inefficiencies and automate time-consuming tasks to boost productivity and up your game.

All from just £64 a user per year.

Game-changers

Streamline workflows and processes

Break down the stages of your work to increase visibility.

Automation

Build automatic triggers and transitions into your workflow.

Statutory deadline management

Manage tasks based on statutory deadlines.

WorkFlow. Perfect for growing practices. Essential for larger ones.

Buy now More features

Part of the practice management suite

Manage clients, communications, tasks and workflow, time and compliance

throughout your practice and across the entire TaxCalc ecosystem.

Add on simple client onboarding

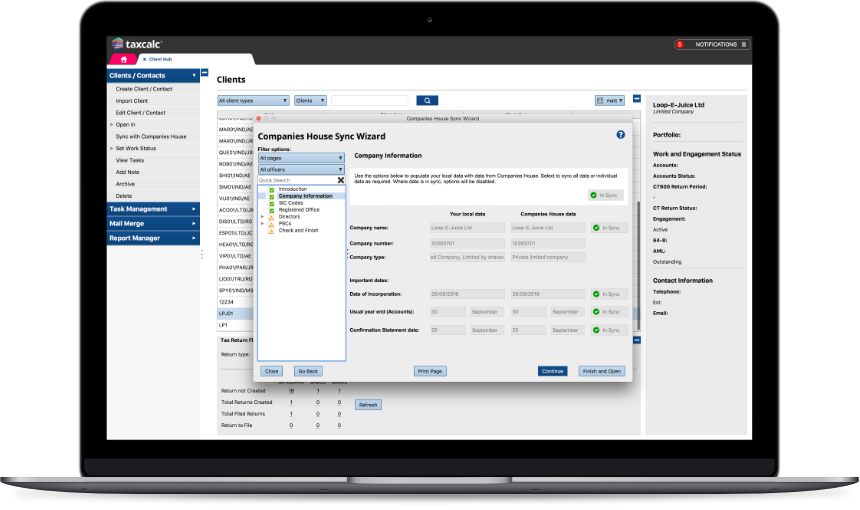

Companies House Advanced Integration

Collecting and maintaining client data can be a long and monotonous task, but with Companies House Advanced Integration this will become a quick and simple process.

Companies House Integration

£194.00 / year

See TaxCalc in action

Find out how TaxCalc can switch on your digital practice.

Start a free 14-day trial and see for yourself.

Try everything! See for yourself how easy TaxCalc is to use.

Take a trialNo payment card required

Call us about your practice software needs.

Find out more about what TaxCalc can do for your practice.

Speak to our Sales Team

0345 5190 883

Features

Working alongside Practice Manager, WorkFlow gives you the

functionality of sophisticated PM systems for considerably less.

Advanced workflow and checklists

Power through jobs and tasks

WorkFlow makes it easy to implement improved processes and keep tighter reins on job progress, freeing you up to grow your practice:

- Make sure you meet all statutory deadlines. Create templates based on key tax and accounting dates and apply them to multiple clients

- Create jobs and set up the tasks required to execute the job. Completing a tax return? Create it as a job, then set up the tasks required to complete the job efficiently

- Customise the workflow for each job. Set up templates with all the required tasks and reminders, so you and your staff can simply follow the same process time and time again

- Use a Template to start a Job and use any changes on recurrence (ideal for non TaxCalc work such as Payroll).

- Auto-populate dates from information already in TaxCalc.

- Save admin time by setting up automatic notifications for regularly recurring jobs, such as VAT or tax returns

- Assign the job/tasks to specific members of staff/team or select Portfolio Manager/Custom User Role to auto assign to the correct user on job creation

- Identify bottlenecks and remove them. Assign multiple staff members for different jobs to keep the job moving through your practice

- Customise tasks with automation so you don't have to manually update them - for example, when submitting a set of accounts automatically change the job/task status to complete or notify another user of the change.

- For simple workflows or processes create SimpleStep® checklists to make sure no steps are missed

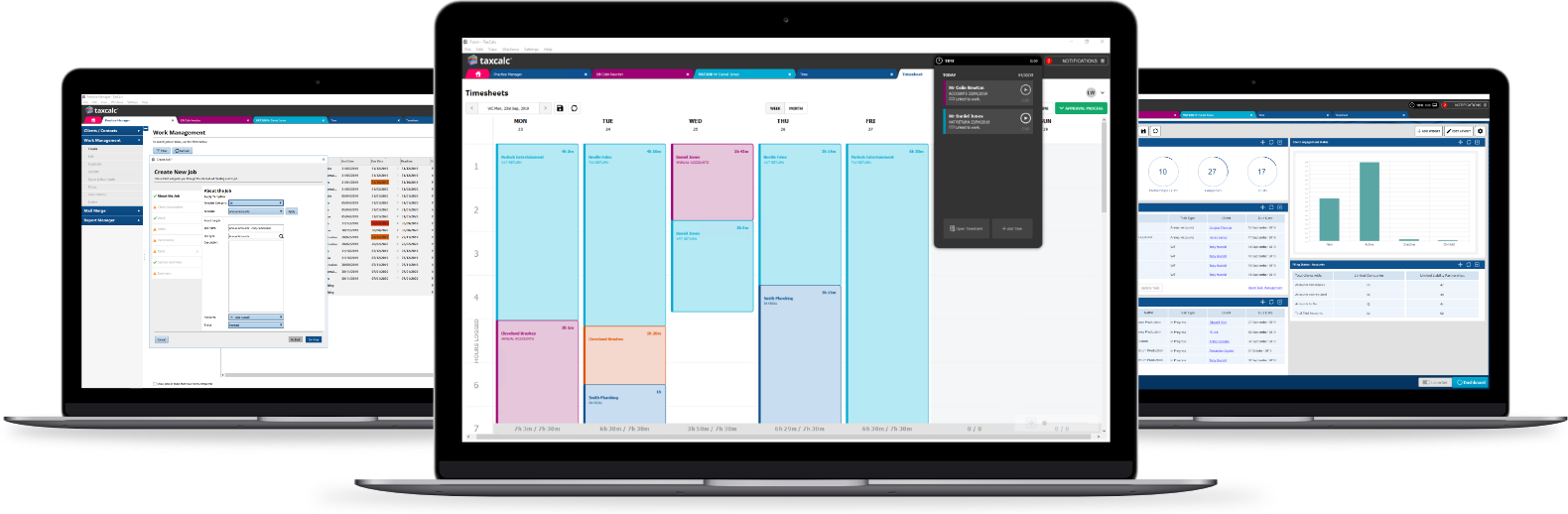

Dashboards

Get the complete picture

With WorkFlow, you are in command of all you survey.

Multiple dashboards

- Gain an overview of all activity and information in one handy snapshot

- Organise information in whatever way you want

- Set up different dashboards to monitor particular functions

- Share with different users in the practice.

Private dashboards

- Set up different dashboards to monitor particular functions for personal use

- Maintain tight control over specific workloads.

Public dashboards

- Display and share information with all staff

- Ensure consistency across your practice.

Customise

- Filter your dashboard widgets by user, team, portfolio manager, custom user role, activity type, date or Office.

System requirements:

TaxCalc is optimised to work on the specified versions of the operating systems listed below and all software releases are tested on them. An internet connection is required to receive updates and use certain parts of the software (e.g. file online to HMRC).

Mobile devices, tablets and Chromebooks are not currently supported.

Server installation:

Microsoft Windows (64-bit)

- Windows Server 2019

- Windows Server 2016

- Windows Server 2012

- Windows 11

- Windows 10 (All versions)

- Windows 8.1

Information about hosted desktop environments.

Standalone / Client installation

Microsoft Windows (64-bit)

- Windows 11

- Windows 10

- Windows 8.1

Apple Mac (64-bit only)

- 13.00 Ventura

(v13.1.006 onwards) - 12.00 Monterey

- 11.00 Big Sur

Linux (64-bit Kernel)

- 3.10 or higher, Debian (e.g. Ubuntu) or Redhat based distributions

- Graphical User Interface (GUI)

- Office productivity software (export to Word / Excel)

Additional requirements

- Appropriate hardware is required

- Adobe Acrobat Reader 9.0 or higher

- Microsoft Office 2010 or later (export to Word / Excel)

Information on partially supported systems and others which are no longer supported.

WorkFlow videos

Take a few minutes to familiarise yourself with WorkFlow

to see the full benefit it could bring to your practice.

Creating a dashboard

Set up a dashboard in TaxCalc to display your key metrics.

Setting up job templates

Configure your workflow with custom or default templates.

Starting a job for a client

Start a job for a client from your workflow.

How to set up multiple offices

Set up and define the various offices you and your team work from.

Frequently asked questions

Below you'll find answers to questions you may have about WorkFlow.

If you'd like to know more, please call us on 0345 5190 883 or email sales@taxcalc.com.

What does WorkFlow include?

WorkFlow provides additional tools to automate and manage your practice.

What do I have to do to get set up and start using WorkFlow?

Please see our getting started guide for WorkFlow.

How many users can use WorkFlow?

WorkFlow is licenced on a per user/per year basis, so you need to purchase the number of users that will use the software. Please see our Versions and Prices page.

If I stop using WorkFlow, will my Jobs still be available?

Once your licence has expired, you’ll still be able to access and progress any open Jobs up to completion. However, it will not be possible to create or activate any new Jobs. You can create or activate a corresponding standalone Task for the same type of work to use our standard Practice Manager functionality.

What type of Jobs can

I create?

You can create Jobs for almost anything you need to track progress on. To create a Job, simply select from a customisable list of client and non-client activities. For common Jobs, you can apply a Job template or just create ad-hoc Jobs that may need to change over time.

To get you started, we‘ve provided several templates that set workflows for key jobs. You can also construct your own templates, letting you work exactly as you need to.

What is the difference between a Job and a Task?

Jobs are only available within WorkFlow and contain baskets of tasks that act as stages of the Job, ideal for transitioning through a workflow. For example, a tax return is a job and can contain tasks such as requesting tax return information from the client, receiving tax information, preparing the tax return and submitting the tax return to HMRC. Having separate tasks allows you to manage and report on the progress of your work more accurately and effectively.

Where a staged approach is not required, standalone Tasks can be created. Tasks have an assignee and a status and can be used for an item of work e.g. a tax return or a meeting, they don’t have separate manageable stages though.

Is a free trial available for WorkFlow?

Yes, WorkFlow is included as part of the free 14-day trial. If you would like to know more about WorkFlow, please call our Sales Team on 0345 5190 883 or email sales@taxcalc.com.