What's new?

Latest updates

Tax Return Production

What If? Planner

now live for 2023/24

What If? Planner is our powerful tax planning tool that allows you to project your clients' future tax liabilities with ease. Now fully up to date for 2023/24, you can accurately identify opportunities to reduce payments on accounts, plan for known changes in circumstances and provide estimates for investment property sales; with zero risk of interfering with any live tax return data.

Improved reporting

pack for clients

Because professional appearance matters, you now have a personal tax computation cover sheet to keep your client tax return pack neat and tidy. We have also added the ability to use alternative firm details on our popular Corporation Tax cover sheet for those practices with more than one office.

Improved corporation tax loss

handling and error checking

To ensure tax losses do not go unclaimed, losses brought forward are now automatically set against current year profits. We have also introduced new Check and Finish® validation messages to identify any mismatch between carried forward losses in earlier returns against brought forward losses in subsequent returns – particularly useful for ensuring accuracy when amending a previous year's CT return.

Dividend Database

now live for 2022/23

With Dividend Database there's no need to spend time searching for clients' dividend payments, it's all there in a few clicks. Our latest update includes all FTSE350 and AIM listed company dividend information.

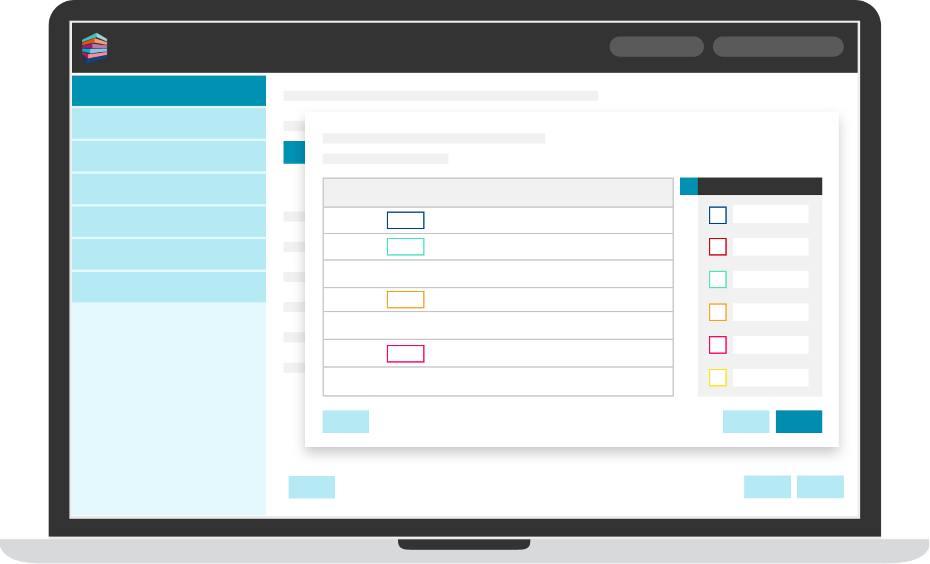

Online filing restriction

by security role

Concerned about junior, or even senior, members of your team having the ability to file tax returns without following due process? No need. We have added the ability to restrict online filing capability by security role, giving you complete control over who has permission to file live tax returns to HMRC.

Improved visibility of

personal tax filing status

We have added the tax return submission status to the select tax return window within Tax Return Production; allowing you to see the status of all your clients' tax returns without needing to navigate to Practice Manager or go to the online filing screen. For greater visibility, we have also added a 'Submitted By' field to the online filing history.

Accounts Production

Electronic submission

of revised accounts

It is now possible to prepare revised/amended accounts and submit these electronically to Companies House. Gone are the days of filing these on paper.

Expanded chart of

accounts for LLPs

Following on from a similar enhancement in our Spring release for limited companies, we have now included additional nominal codes for tangible and intangible assets, investments, subsidiaries, associates and joint ventures for LLPs. As well as giving more flexibility, this allows us to improve the automatic note generation in these areas.

2023 taxonomy update

As always, we keep our products fully up to date with the latest iXBRL filing schema.

New financial statements

drill down facility

No need to navigate to the trial balance and go in search of your accounting entries, you can now click figures directly on the face of the accounts to view and amend in situ. A simple enhancement that allows for speedy review and adjustment of the accounts.

Online filing restriction

by security role

Concerned about junior, or even senior, members of your team having the ability to file accounts without following due process? No need. We have added the ability to restrict online filing capability by security role, giving you complete control over who has permission to file your clients’ accounts.

Practice Manager

New SimpleStep®

checklists

Practice Manager Plus users can now benefit from the creation of SimpleStep® checklists to ensure your team completes all required tasks associated with a job or process. These checklists can be used for any process, client-related or internal, such as new client onboarding, forming a limited company or inducting a new member of your team. These SimpleStep checklists give you the power to systemise every element of your practice.

New data mining conditions

It is now possible to mine your database for total client fees. This means you can create reports illustrating your highest (or lowest) value clients. You can even generate mailing lists to target specific client bandings, perhaps to invite them for an overdue pricing review. We have also enhanced our data mining to identify the usual year end for all relevant clients, not just those with a business record. Great for scheduling some pre-year end planning comms.

Flexible task completion

within a workflow

We recognise that not all workflows are required to be linear and so have now added the ability to complete any task out of sequence – without having to mark all previous tasks as completed. This is particularly useful for more complex workflows where, for example, some tasks are completed concurrently by different members of your team with no requirement for one to be done before the other.

New dashboard filters

In order to increase the flexibility of dashboards, our jobs and tasks widgets can now be filtered by team and portfolio manager. This allows key information to be visible on the dashboard, rather than having to filter results in work management. Super useful for when your client teams are managing a backlog of work or where each portfolio manager wants to keep an eye on their clients' work but the work isn't necessarily assigned to them.

Communications Centre

New email tokens

We have created additional email tokens for services, fees and the due date for Corporation Tax. This gives you greater flexibility to create dynamically generated letters of engagement and Corporation Tax payment reminders; utilising the power of our integrated database in your client communications.

Email subject line tokens

Tokens can now be used within the subject line of emails sent from Communications Centre for both ad hoc messages and when using templates. Great for personalising your communications to ensure they grab your clients' attention.

eSign Centre

Further flexibility

for envelope recipients

Any relationship type can now be added as a signatory to your eSign envelopes. This allows you to obtain secure signatures from shareholders, spouses, civil partners and more. You are no longer restricted to just your client or company officeholders, thus increasing the range of documents you can send for signing.

Improved visibility of signed envelopes

We have enhanced the eSign Centre activity table to display the date the documents were all fully signed off. You can now filter the 'Completed' status to show documents signed yesterday, within the last seven days, within the last 30 days or any date range of your choosing.

Document re-ordering

It is now possible to re-order documents after they have been added to an eSign envelope prior to sending them to your client. This saves you having to remove and re-attach documents upon realising you need them signed in a particular order.

Additional envelope delivery statuses

We have introduced new 'Failed' and 'Sent' delivery statuses to give you greater visibility over the progress of your eSign envelopes. Giving you the assurance you need that your client has received those all important documents.

AML Centre

Improved visibility of client due diligence

By popular request, we have enhanced the Status Management overview within AML Centre to allow the removal of archived clients and filtering of the status columns. This allows your MLRO, and any other authorised users, to quickly identify any clients needing their attention, regardless of which stage in the due diligence process they are at.

VAT Filer

Online filing restriction by security role

Concerned about junior, or even senior, members of your team having the ability to file VAT returns without following due process? No need. We have added the ability to restrict online filing capability by security role, giving you complete control over who has permission to file live VAT returns to HMRC.

For the full story

For a full list of updates, please see the release notes in our Knowledgebase.

Recent updates

We regularly release new features and enhancements to TaxCalc, take a look at our previous release.

See our previous release