VAT Filer

From £93 per year

Bridging the digital gap

Designed for ease of use and built for efficiency, TaxCalc VAT Filer bridges the gap between your clients' digital bookkeeping records and their VAT return for fast submission to HMRC.

Key features

What makes our software stand out? It's not just what it does. It's how it does it.

Spreadsheet compatible

Enabling you to maintain spreadsheets with clients for whom that is the preferred solution.

Secure data storage

All your client VAT data and documents stored securely in one location.

Full visibility

View the VAT obligation status, liabilities, payments and penalties for all your clients.

VAT Filer comes on an annual licence. Run it on your computer, over your office network or work in the Cloud using our CloudConnect® service and we'll securely host and back-up your practice data.

Buy now More features

MTD for VAT

It's now mandatory for all VAT-registered businesses to comply with the MTD for VAT regime. MTD requires records to be maintained digitally and for VAT figures to be submitted to HMRC via specialised APIs.

TaxCalc VAT Filer lets you efficiently prepare VAT returns and be fully compliant with MTD for VAT with simple solution to transfer data from spreadsheets or bookkeeping solutions via digital links before submitting on to HMRC.

VAT Filer in action

Find out how VAT Filer can help transform the way you work.

Start a free 14-day trial and see for yourself.

Try everything! See for yourself how easy TaxCalc is to use.

Take a trialNo payment card required

Call us about your practice software needs.

Find out more about what TaxCalc can do for your practice.

Speak to our Sales Team

0345 5190 883

Features

MTD VAT Filer is simple and intuitive to use and packed with user-friendly features to speed you through your VAT returns.

Compliance and Filing

Produce VAT returns in accordance with the MTD regulations and file them directly with HMRC.

- Suitable for monthly, quarterly or annual VAT returns

- Reduce errors and automatically create VAT periods by retrieving VAT obligations directly from HMRC

- Digitally submit VAT returns to HMRC using API service

- Check and Finish routine to validate entries within the VAT return

- Create and print the following VAT forms for clients using TaxCalc HMRC Forms:

- VAT 1 - Application for registration

- VAT 7 – Application to cancel your VAT registration

- VAT 68 – Request for transfer of a registration number

- VAT 484 – Change of details

Fast and Simple Data Entry

Efficient capture and validation of VAT information

- Quickly and easily import spreadsheets from Excel, or any CSV into VAT Returns using an on-screen cell selector

- Calculate and digitally record adjustments to your VAT Return using our smart adjustment wizards

- Digital links maintained, as required by the MTD regulations

- Keep an electronic copy of your supporting documents within easy reach by storing attachments alongside filed VAT Returns

Full Client Visibility

Always be in full control of your clients’ VAT position

- Build a picture of your clients’ VAT history by retrieving previous VAT returns directly from HMRC. Ideal for newly engaged clients

- Keep on top of your client's VAT position by retrieving VAT payments and liabilities directly from HMRC

- Use TaxCalc eSign Centre to electronically approve VAT returns prior to filing

- Reduce risk of penalty by retrieving accumulated penalty points directly from HMRC

- Use TaxCalc Practice Manager to assign work, monitor due dates, create tasks and track the progress of VAT return jobs through your practice

VAT Filer in action

Find out how VAT Filer can help transform the way you work.

Start a free 14-day trial and see for yourself.

Try everything! See for yourself how easy TaxCalc is to use.

Take a trialNo payment card required

Call us about your practice software needs.

Find out more about what TaxCalc can do for your practice.

Speak to our Sales Team

0345 5190 883

System requirements:

TaxCalc is optimised to work on the specified versions of the operating systems listed below and all software releases are tested on them. An internet connection is required to receive updates and use certain parts of the software (e.g. file online to HMRC).

Mobile devices, tablets and Chromebooks are not currently supported.

Server installation:

Microsoft Windows (64-bit)

- Windows Server 2019

- Windows Server 2016

- Windows Server 2012

- Windows 11

- Windows 10 (All versions)

- Windows 8.1

Information about hosted desktop environments.

Standalone / Client installation

Microsoft Windows (64-bit)

- Windows 11

- Windows 10

- Windows 8.1

Apple Mac (64-bit only)

- 13.00 Ventura

(v13.1.006 onwards) - 12.00 Monterey

- 11.00 Big Sur

Linux (64-bit Kernel)

- 3.10 or higher, Debian (e.g. Ubuntu) or Redhat based distributions

- Graphical User Interface (GUI)

- Office productivity software (export to Word / Excel)

Additional requirements

- Appropriate hardware is required

- Adobe Acrobat Reader 9.0 or higher

- Microsoft Office 2010 or later (export to Word / Excel)

Information on partially supported systems and others which are no longer supported.

TaxCalc in action

We pride ourselves on delivering high quality and easy to use software. Please click on a screenshot below to see how you use TaxCalc and see how easy it is to complete a clients' VAT return.

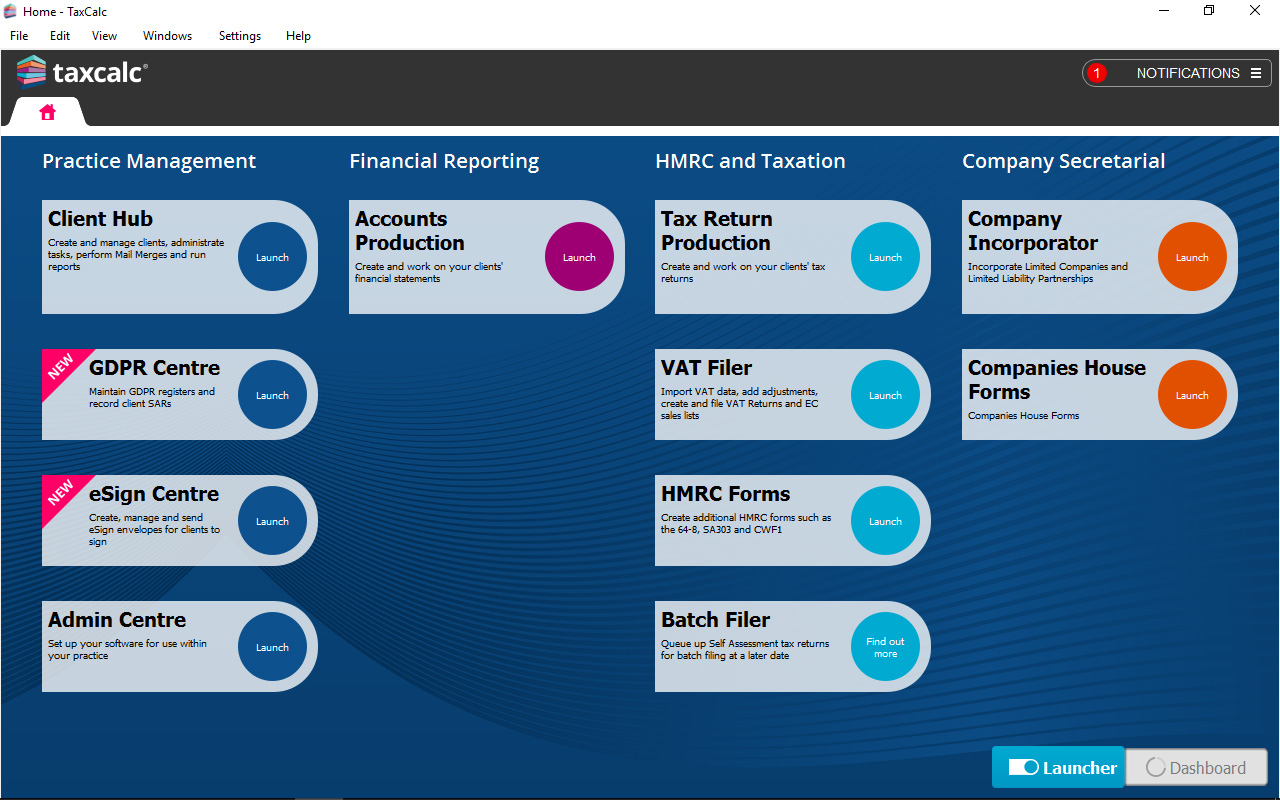

Main TaxCalc Launcher screen.

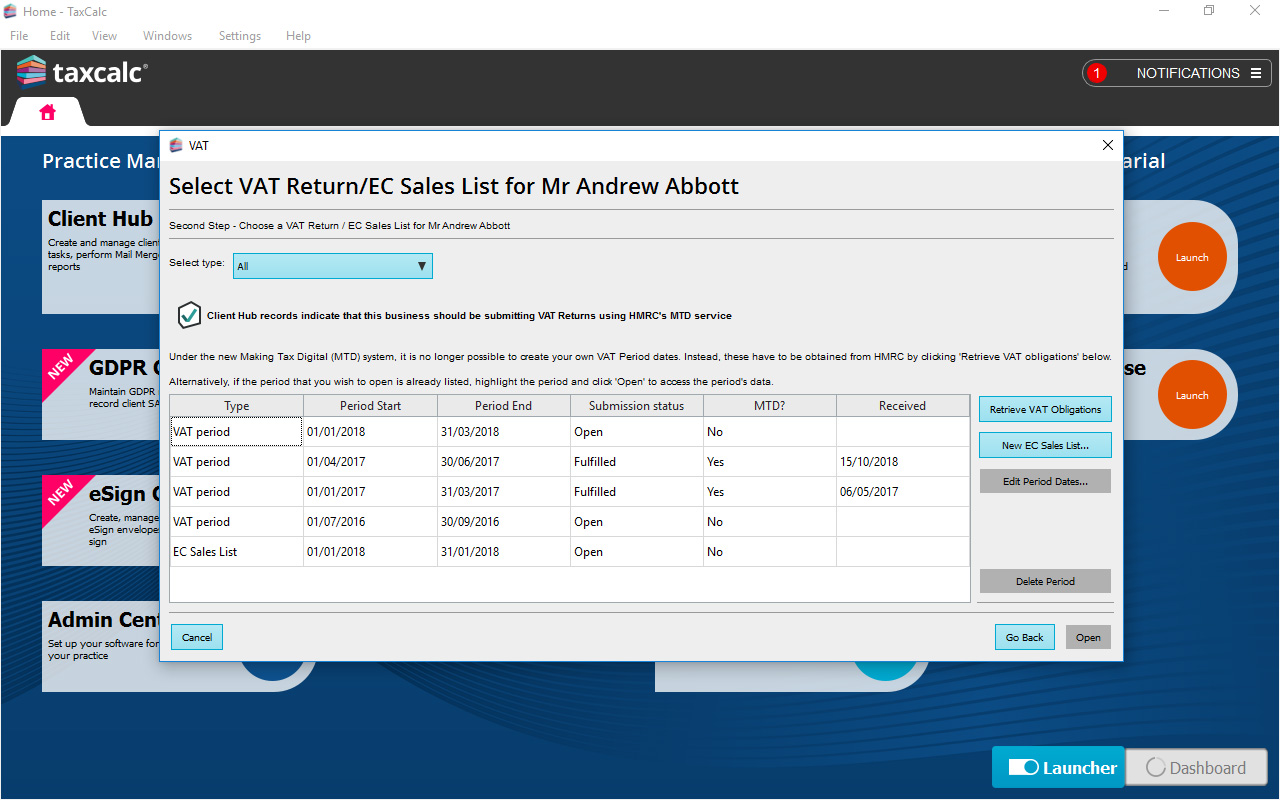

All your VAT Returns can be easily accessed and their online status determined, all on one screen.

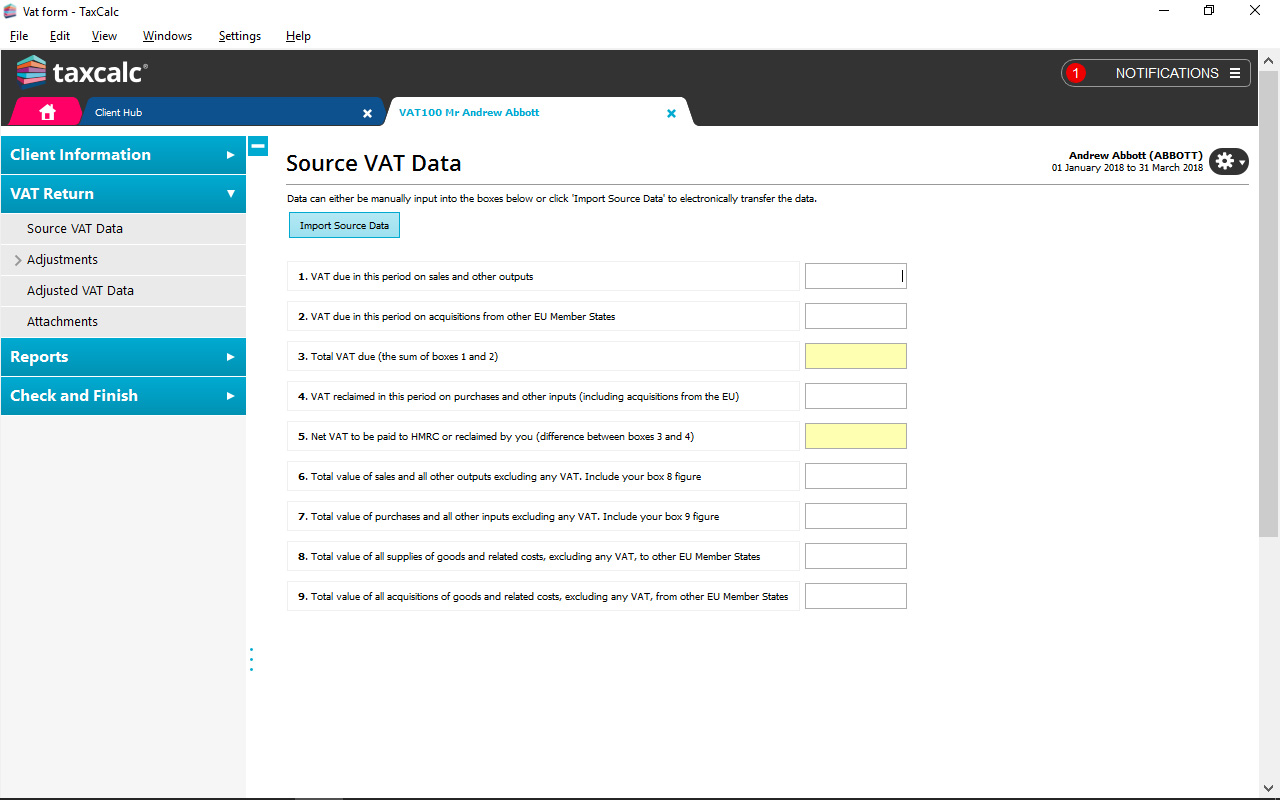

VAT Returns are very easy to complete.

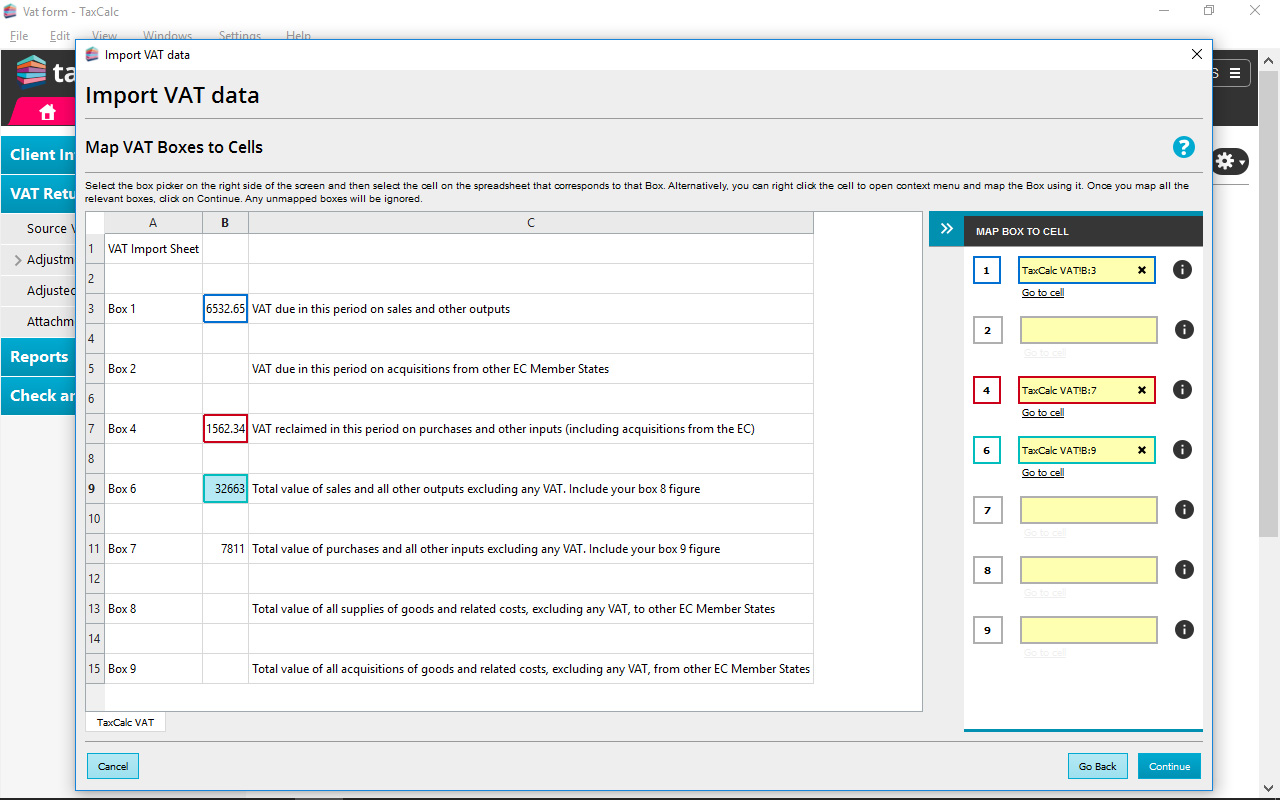

Use the import routine to quickly import VAT source data from a spreadsheet.

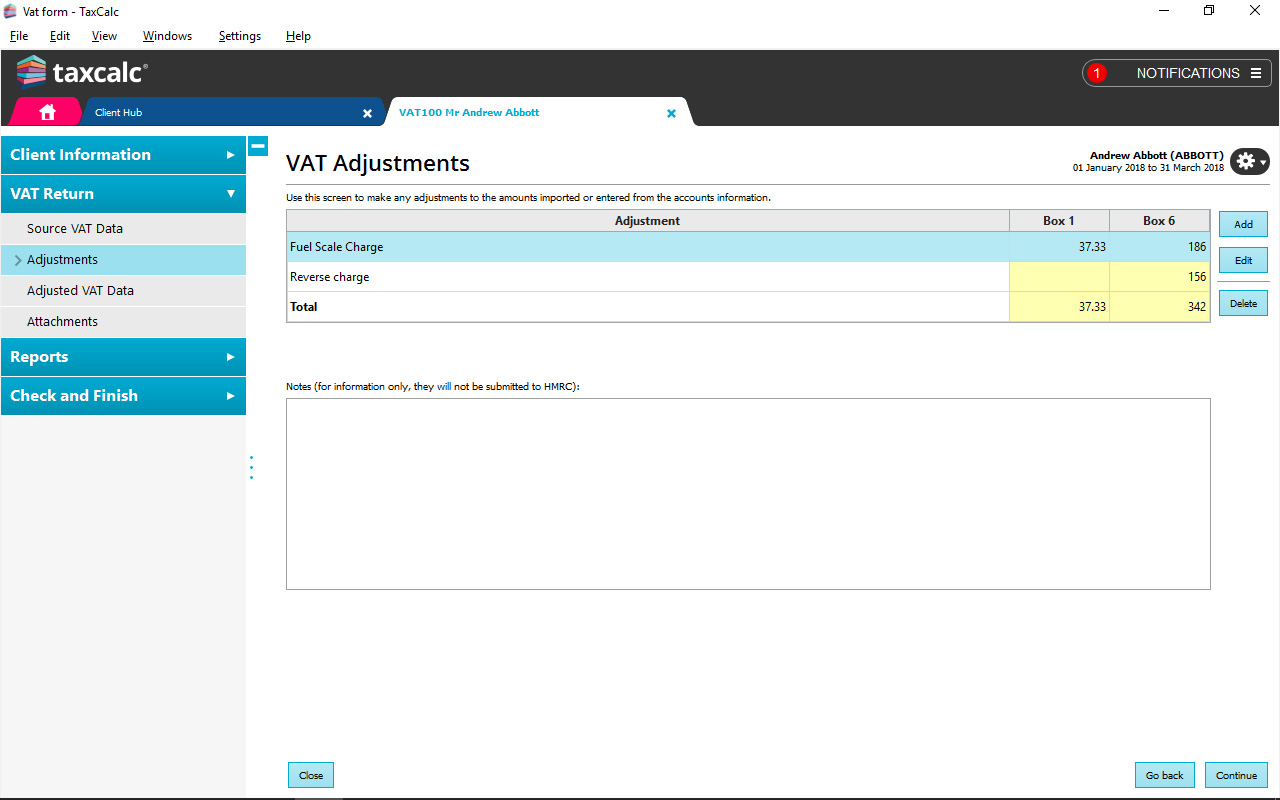

Use the adjustments page to easily add any adjustments that may be required to the source data.

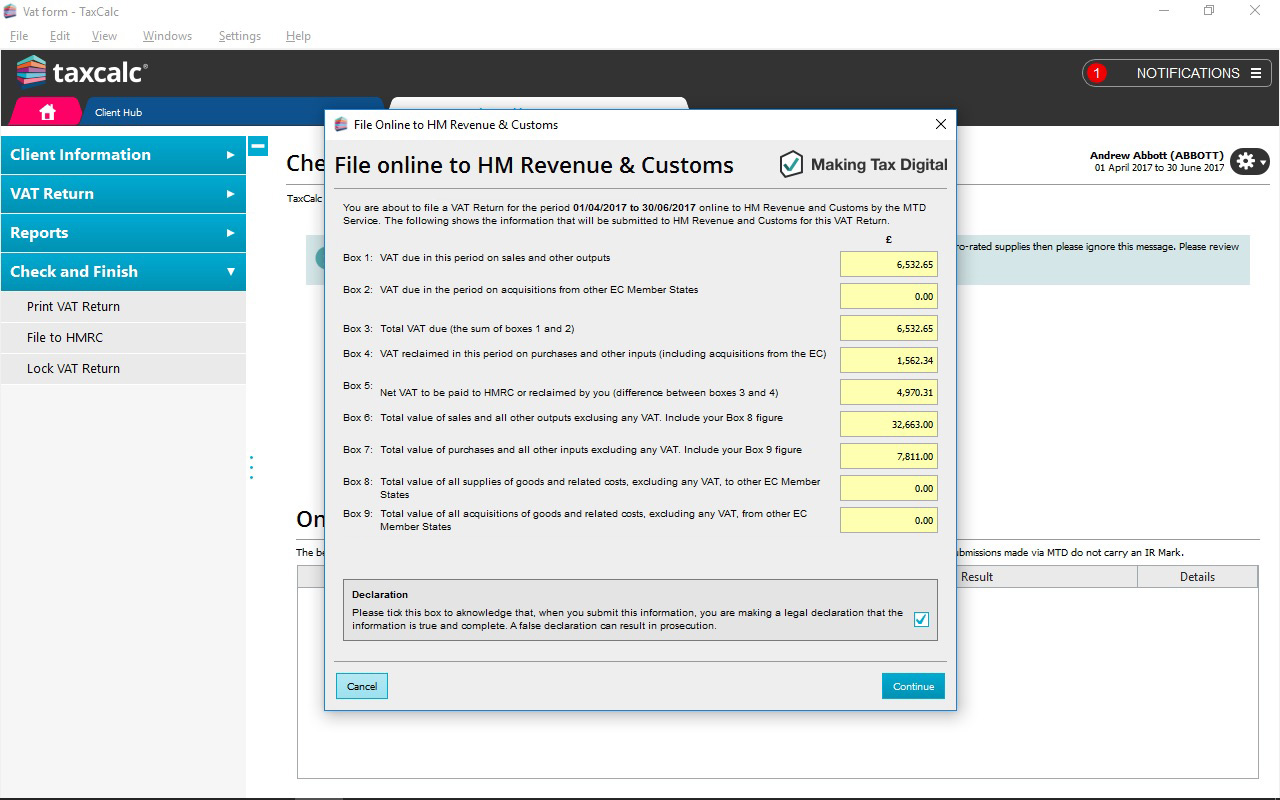

Submission of VAT Returns to HMRC is straight forward and completed with a few button clicks.

Frequently asked questions

Below you'll find answers to questions you may have about TaxCalc VAT Filer.

If you'd like to know more, please call our Sales Team on 0345 5190 883 or email sales@taxcalc.com.

Can I import data from any spreadsheet?

VAT Filer has the ability to quickly and effortlessly import data from spreadsheets via our software bridging solution. With a few button clicks, boxes from the VAT Return can be mapped to your spreadsheet and imported into the VAT data screens so you can start the process of completing your VAT Return.

Can I import data directly from my bookkeeping software?

VAT Filer doesn’t have the ability to import VAT return data directly from bookkeeping software as none of the major software companies provide APIs for us to use for this purpose. However, you can export the VAT return from your bookkeeping package and use our import routine to make your submission using VAT filer.

Can I add supporting documentation to my VAT Returns?

Supporting documentation can be added to a VAT Return via our ‘Attachments’ page. Please note that the documentation added is for your reference purposes only and will not be sent to HMRC with your VAT Return.

Can I produce EC Sales Lists using VAT Filer?

EC Sales Lists can be produced and submitted to HMRC using VAT Filer but since 1 January 2021 this only applies if you sell goods from Northern Ireland (known as Northern Ireland protocol transactions) to EU VAT-registered customers. HMRC will recognise the branch number of '121' to determine that you are a Northern Ireland trader.

Can I use VAT Filer for my own business or is it just for accountants?

VAT Filer can be used both by businesses and by accountants. For a business to be able to submit VAT Returns without the assistance of an Agent, you will need to use your Government Gateway credentials.

Is TaxCalc included on HMRC’s software suppliers list for VAT?

Yes. We're included on HMRC’s software supplier’s list as Acorah Software Products Ltd (TaxCalc).

VAT Filer in action

Find out how VAT Filer can help transform the way you work.

Start a free 14-day trial and see for yourself.

Try everything! See for yourself how easy TaxCalc is to use.

Take a trialNo payment card required

Call us about your practice software needs.

Find out more about what TaxCalc can do for your practice.

Speak to our Sales Team

0345 5190 883