Accounts Production

From £156 per year

Free yourself from compliance

Streamline your processes and stay compliant in an increasingly complex financial landscape. Effortlessly prepare accurate financial statements for Sole Traders, Partnerships and micro, small, medium and large Limited Companies, Limited Liability Partnerships and Groups.

TaxCalc Accounts Production makes those complex accounts preparation tasks simple - dramatically boosting your efficiency and allowing you to spend time on those higher value services.

Game-changers

Compliance without fuss

With a rich level of flexible features, customise client accounts and comply with their needs.

Reporting made easy

Simple data entry and superfast report generation with live editing and built-in iXBRL.

Express Companies filing

Electronically file accounts directly with Companies House in just a few clicks.

Key features

Choice of formats

A variety of templates allows you to produce accounts confidently for both unincorporated and incorporated entities supporting FRS 105, FRS 102 1A, FRS 102, charity accounts and consolidated accounts.

SimpleStep data entry

Let us navigate you through all stages of your accounts preparation, from posting to submission, with our intelligent and guided data entry process.

Flexible posting batch generation

Import from from Xero, FreeAgent and QuickBooks or manually enter your transactions, the choice is yours. With automated year-to-year routines and template batch options to super-charge your workflow.

Guidance on disclosures

You’ll know exactly what is; required by law, encouraged or simply user choice with our smart compliance filters and automatic disclosures.

Customisable reporting

Take control of your output with easy to use, intelligent and customisable reporting. Set notes and preferences for all clients or tailored for each client as required.

Second pair of eyes

Our unique Check and Finish traffic light validation examines your data for errors and inconsistencies, providing that comfort that we are always there by your side.

Supported

Our support is unlimited and provided at no extra charge. Our team has technical know-how and practical accountancy experience, so you know that whatever your problem, we can find a solution.

Plus

Integrated solution

All our products are built on a single platform. With one application and one database, you’ll find integration and data sharing at the heart of TaxCalc.

Integrate seamlessly with Tax Return Production and other tools in the TaxCalc suite, including Practice Management to speed you through tasks and jobs.

Manage your practice

Supplied at no extra cost, Practice Manager offers client management and work tracking, and is part of a suite of powerful practice management tools.

Award-winning support

Provided by our UK support team. This service is unlimited and provided at no extra charge.

Integrations with leading

bookkeeping software

Using our familiar import trial balance wizard, import a year end trial balance directly from online accounting software and seamlessly export journals or adjustments back.

The seamless integration allows the import to be completed within a few easy steps giving a number

of impressive benefits including:

- Time saving

- Reducing administration

- Increasing accuracy

- Limiting the need for manual data entry

Accounts Production in action

Find out how Accounts Production can help transform the way you work.

Start a free 14-day trial and see for yourself.

Try everything! See for yourself how easy TaxCalc is to use.

Take a trialNo payment card required

Call us about your practice software needs.

Find out more about what TaxCalc can do for your practice.

Speak to our Sales Team

0345 5190 883

Versions and prices

Our software is available with a no-cost server option, providing great benefits of centralised data storage and management. TaxCalc Accounts Production is sold on an annual licence basis. You can be sure of finding a version to suit your practice:

FRS 102 MLA is available as an additional add-on.

Additional users are charged on a concurrent usage basis at just £152 plus VAT.

Features

TaxCalc Accounts Production is the simplest and most complete way to meet your clients’ accounts compliance needs.

Compliance and Filing

Produce accounts in accordance with the latest compliance and save time filing electronically.

- Create Limited Company, LLP, Group, audited or unaudited accounts for filing to Companies House online*

- Create SORP-compliant accruals Charity Accounts for Charitable companies (limited by guarantee), Charitable Incorporated Organisations and Charitable Unincorporated Associations

- Create Community Interest Company (CIC) accounts along with the Community Interest Report, ready for electronic submission to Companies House via their ZIP portal (file package accounts with Companies House service).

- Create Amended/Revised accounts and file these electronically to Companies House

- Quickly check the filing status of all accounts submitted to Companies House online

- Create Limited Company accounts in iXBRL file format for submission to HMRC

- Create Income and expenditure reports for Sole Trader and Partnership clients

- Modern interface provides for a fast and efficient entry of financial data

- Automatic updating for new features and compliance throughout the life of your licence

* An account with Companies House is required to file online, similar to obtaining agent filing credentials with HMRC.

Supporting Schedules

Analyse and complement any final accounts with additional and supporting documents.

- Generate a Trial Balance in round pounds

- High quality interactive lead schedule, trial balances and nominal ledger reports

- Drill down to a specific transaction in a posting batch with your audit trail and nominal ledger reports

- Multi-year, historic trial balance reports with variance analysis

Chart of Accounts

- Comprehensive, editable charts of accounts to ensure financial statements can be customised to match your clients’ affairs

- Master chart of accounts editing function to customise to your firm

- Create a list of favourite accounts for fast access to commonly used codes

Integration and sharing data

Easily share and save data minimising the need for re-keying and enabling data transfer and analysis outside of TaxCalc.

- Share self-employment, partnership and limited company accounts data with TaxCalc Tax Return Production

- Long periods of accounts can be split into two Corporation Tax returns when shared with TaxCalc Tax Return Production

- Supports the SNF data transfer standard, to share financial report data with third party (non-TaxCalc) tax products

- Export financial statements to Microsoft Word, Excel, PDF and iXBRL (limited companies)

- Direct import of a year-end trial balance via seamless integration with online accounting software

- Direct export of journals and adjustments via seamless integration with Xero, QuickBooks and FreeAgent

Presentation of Financial Statements

Create financial statements that represent your practice, customise and tailor reports building house standards for use across your practice.

- Roll forward of disclosure notes from previous period

- Fine control over presentation of notes with options for bold, italics, underline, alignment and more

- Transactions and disclosure notes saved on a per accounting period basis

- Live editing of financial statements to update note text in real time

- Review figures quickly on the face of the accounts with our drill down directly to the trial balance and postings.

- Detailed balance sheet gives you a complete transactional breakdown

- Tailor the presentation of the accounts, to include watermark, customised front cover and set left margin for hole punching and binding

- Library of best-practice template notes saves you time writing your own

- Edit notes library at master level for application to all clients

- Build notes with tokens to insert common references such as client name, accounting period dates and more

- Automatic texts to handle gender, possession and pluralisation in notes

- Produce alternative currency financial statements in pounds sterling, dollars and euros

- Edit terms and labels within the financial statements on both client and master level

- Accountant’s report templates suitable for ACCA, CIMA, AAT, ICAEW, ICAS and IFA plus generic report for any QBE practitioner

Posting Transactions

Manual entry or import; speedily enter, adjust, analyse and validate opening balance, working paper and trial balance postings.

- Intuitive, spreadsheet-like posting window with account lookups, modification of accounts titles on the fly, narrative and working paper references

- Template batch option with a choice of default templates for creating a batch, pre-populated with account codes

- Direct import of a year-end trial balance via seamless integration with Xero, QuickBooks and FreeAgent

- Direct export of journals and adjustments via seamless integration with Xero, QuickBooks and FreeAgent

- Import trial balances from all other online accounting/bookkeeping packages via .csv import

- One-time mapping for all imports

- Roll forward routines to bring forward balances from previous period

- Journal reversing function

- Automatic batch balancing feature

- Automatic handling of rounding differences

- Specify favourite commonly used account codes when posting

- Enter narratives, working papers references and dates per transaction

- Insert, delete and reorder transactions

- Copy down narrative feature

Client Types and Formats Supported:

Sole Trader

- Full accounts

- Income and expenditure statement

Partnership

- Full accounts

- Income and expenditure statement

Limited Liability Partnership (LLP)

- FRS 102 for Medium and Large individual LLPs

- FRS 102 section 1A for Small companies

- FRS 105 for Micro-LLPs

- Registrar financial statements (filleted accounts)

- Abridged accounts (FRS 102 section 1A only)

- Audited and unaudited accounts

- Dormant accounts

Limited Company

- FRS 102 for Medium & Large limited companies*

- FRS 102 section 1A for small companies

- FRS 105 for Micro Entities

- Registrar financial statements (filleted accounts)

- Abridged accounts (FRS 102 section 1A only)

- Audited and unaudited accounts

- Dormant accounts

- Revised/Amended accounts

- Company limited by guarantee

- Community Interest Company (CIC) accounts NEW

- Group Accounts† NEW

* Requires the FRS 102 MLA add-on

† Requires the Group Accounts add-on

Accounts Production in action

Find out how Accounts Production can help transform the way you work.

Start a free 14-day trial and see for yourself.

Try everything! See for yourself how easy TaxCalc is to use.

Take a trialNo payment card required

Call us about your practice software needs.

Find out more about what TaxCalc can do for your practice.

Speak to our Sales Team

0345 5190 883

Windows, Mac and Linux

System requirements* An account with Companies House is required to file online, similar to obtaining agent filing credentials with HMRC.

TaxCalc for all firms

We recognise that practices in the UK come in all shapes and sizes.That's why we offer a wide range of Unlimited and smaller pre-built packages to suit your client base.

There is no extra cost for the server options and both come with free, unlimited support.

Standalone

Suitable for startups and those working on their own:

- Local database with option to store tax returns in your own file system or cloud storage (e.g. DropBox)*.

- Designed for a single installation. For multiple standalone machines please contact our team on 0345 5190 883.

- Available for Windows, Mac, and Linux.

* Note that tax returns stored outside of the database will not be included in backups. If you move a tax return file, you will be required to help TaxCalc relocate it.

Server

Suitable for multi-staff offices at one or more locations:

- Central database to store and coordinate all your practice data in your office.

- Easy to use installer. One option for the server (which will auto-configure itself to run as a service on your network) and another option for each of the computers on your network.

- TaxCalc's server software is designed to run over modest, lightweight hardware. You don't even need a dedicated server. In simple setups, you just need to bless one computer on your network with the database and TaxCalc takes care of the rest.

- TaxCalc's software is optimised to run over VPN, so connecting in from remote locations provides superb performance.

- Concurrent user model means that you can install software on as many computers as you like.

- Two concurrent users allowed out of the box with additional users available to buy at just £105 per user.

- Back up all of your clients' accounts, tax returns and other practice records in one go.

If your practice's circumstances change, we can migrate you from the standalone version to the server version. Please call us on 0345 5190 883 to discuss.

TaxCalc and Your Practice - A Short Guide

There's no need to be daunted at the prospect of change: hundreds of practices are moving to TaxCalc and are enjoying the benefit of one integrated software provider.

To learn more about how your practice can install, license and maintain TaxCalc, we've written a detailed guide about this, together with an insight into the technology and user interface design of the software.

DownloadPowerful add-ons to improve functionality

Extend your Accounts Production reporting capability with these helpful add-ons.

Additional formats

FRS 102 MLA

Medium & Large Accounts

Prepare sets of FRS 102 financial statements for limited company and LLP clients, with the flexibility to include the additional FRS 102 disclosures for any FRS 102 s1A clients.

From £78 per year

Learn more Buy nowGroup Accounts

Prepare consolidated accounts and submit them electronically to Companies House with automatic iXBRL tagging.

* Requires a FRS 102 MLA licence.

£70 per year

Learn more Buy nowCharity Accounts

Charity Accounts enables the production of SORP-compliant charity accounts and makes the preparation of financial statements effortless.

From £80 per year

Learn more Buy nowAdd-ons

Encrypted PDF Export

Export your clients’ accounts as encrypted PDF files for secure transmission.

£59 per year

Buy nowBookkeeping Connect

Import trial balances from, and export journals and adjustments to Quickbooks, Xero,

and FreeAgent.

Free

Accounts Production in action

Find out how Accounts Production can help transform the way you work.

Start a free 14-day trial and see for yourself.

Try everything! See for yourself how easy TaxCalc is to use.

Take a trialNo payment card required

Call us about your practice software needs.

Find out more about what TaxCalc can do for your practice.

Speak to our Sales Team

0345 5190 883

TaxCalc in action

We pride ourselves on delivering high quality and easy to use software. Please click on a screenshot below to see how you use TaxCalc and see how easy it is to complete your tax return.

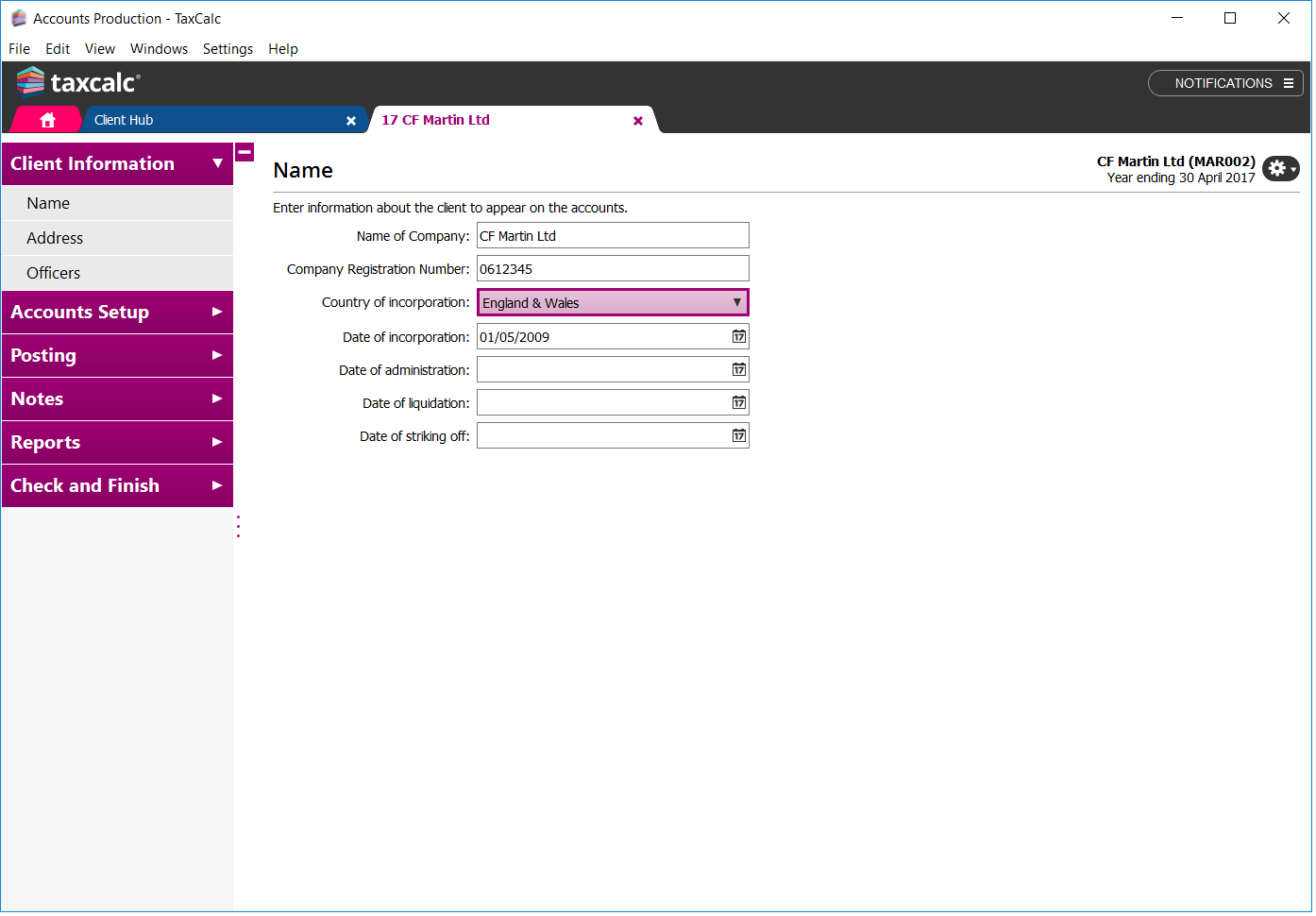

Standing information about your client, such as their name, address, partners and officers are presented to you to review and confirm.

This section also includes the Chart of Accounts, which can be viewed, edited and printed.

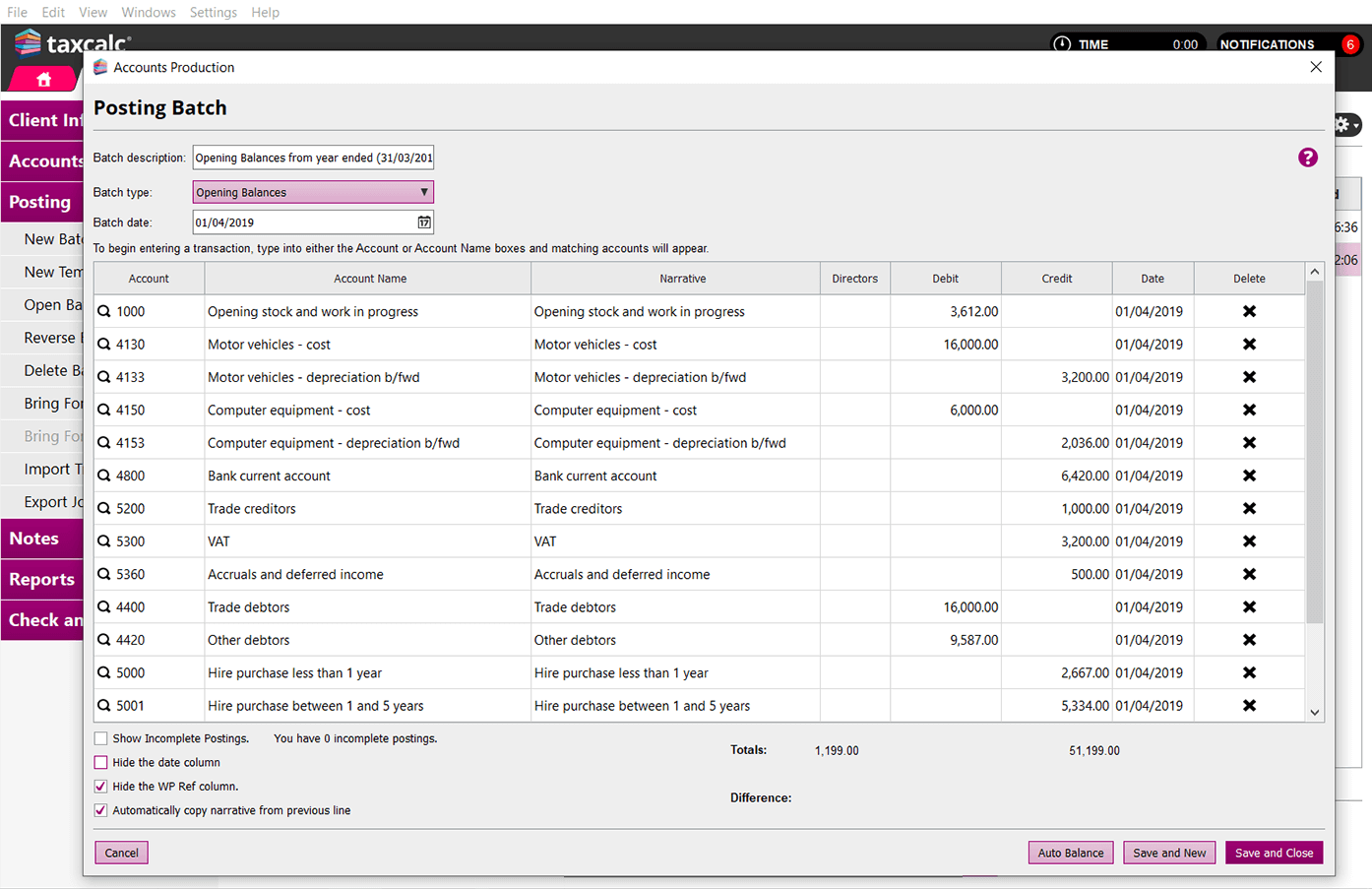

Transactions are entered into one or more spreadsheet-like Posting Batches.

Alternatively, you can import a trial balance directly from accounting/bookkeeping software via seamless integration or using a CSV file.

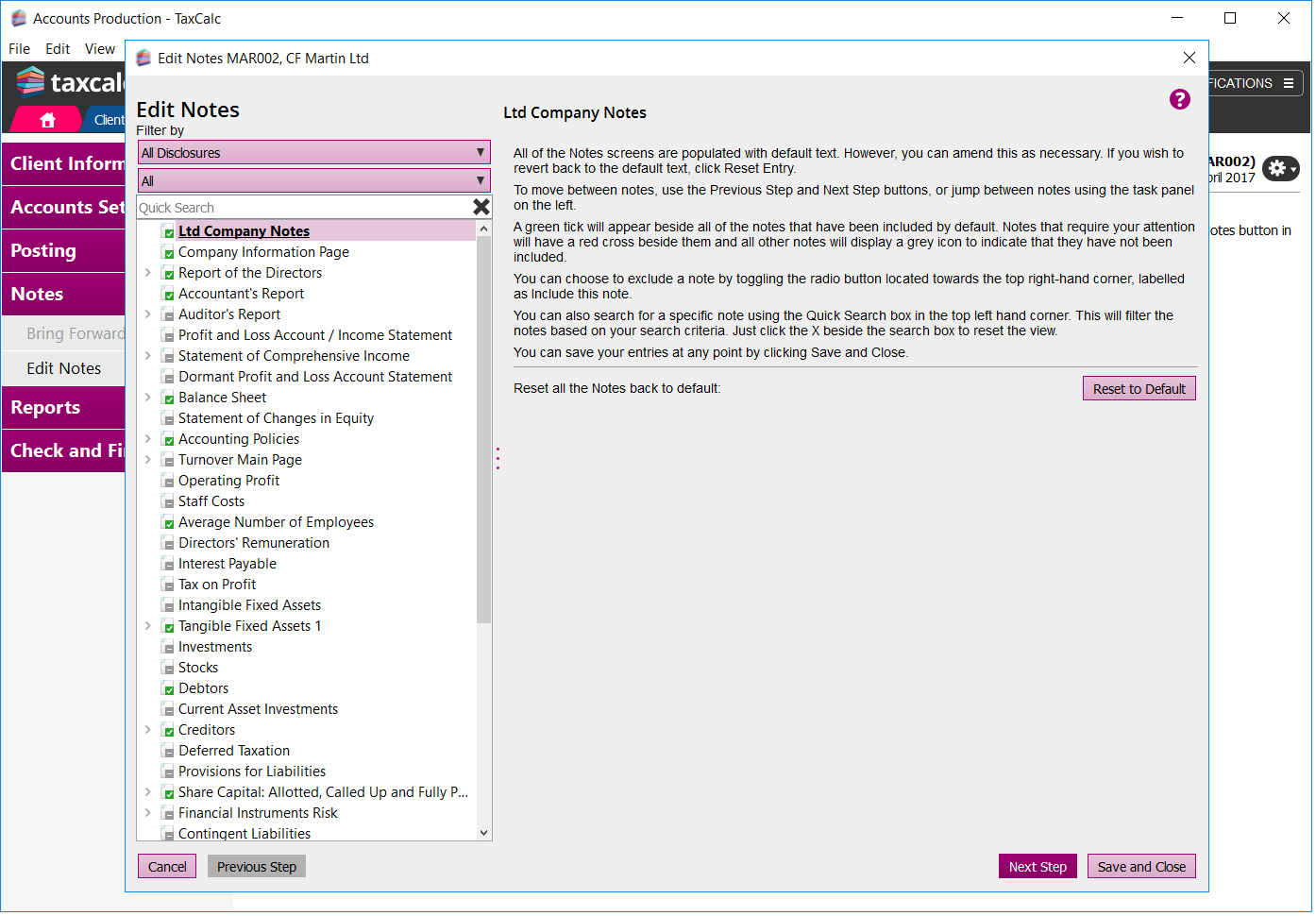

TaxCalc Accounts Production features a library of notes and disclosures that may appear on your clients' financial statements.

Suggested notes are automatically turned on, based upon computed balances.

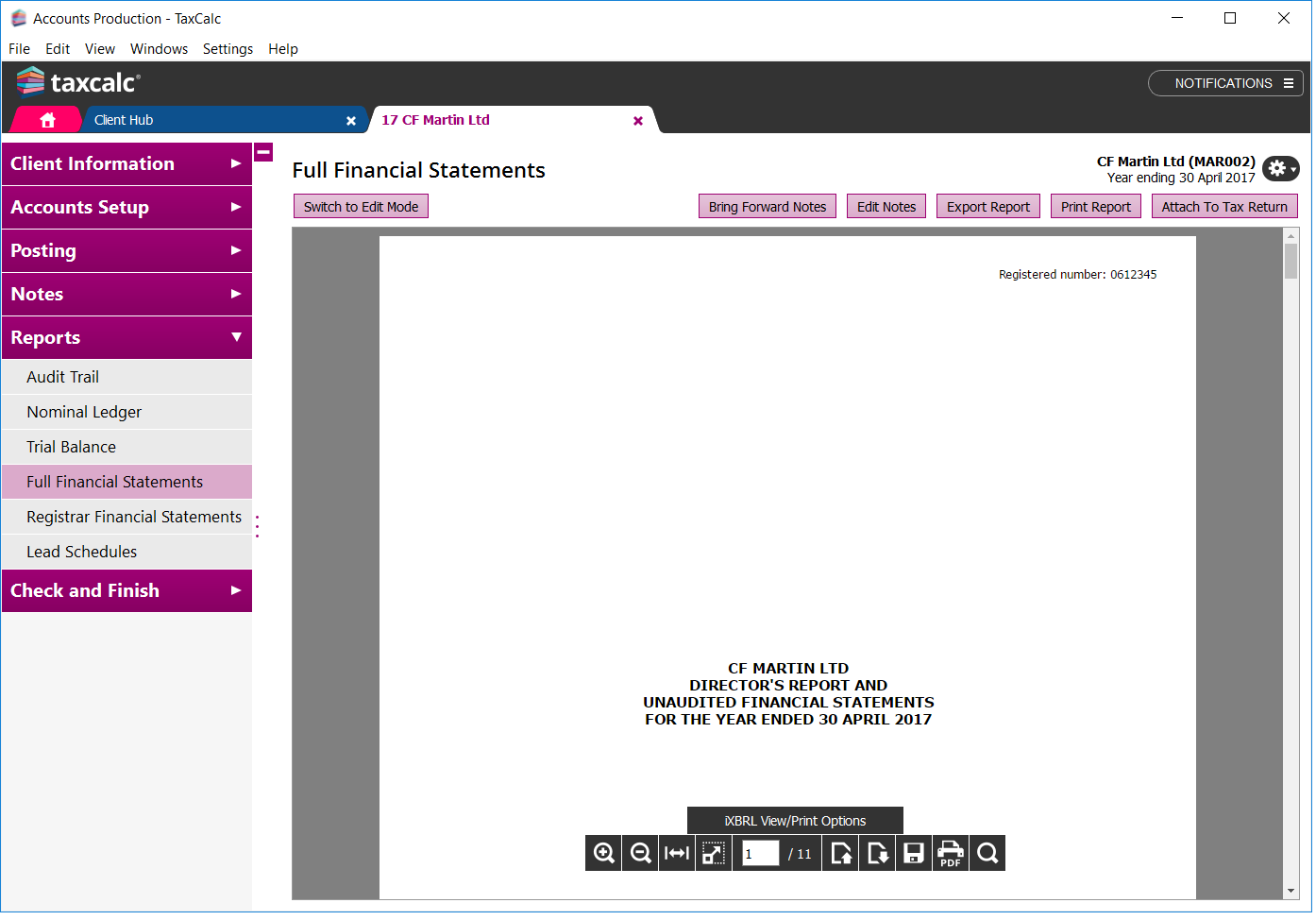

Producing a report in TaxCalc Accounts Production takes just one click. All reports are presented in the left hand menu, ready to be generated.

The system supports full Audit Trail, Nominal Ledger and Trial Balance with drill down and filtering, together with a full set of Lead Schedules.

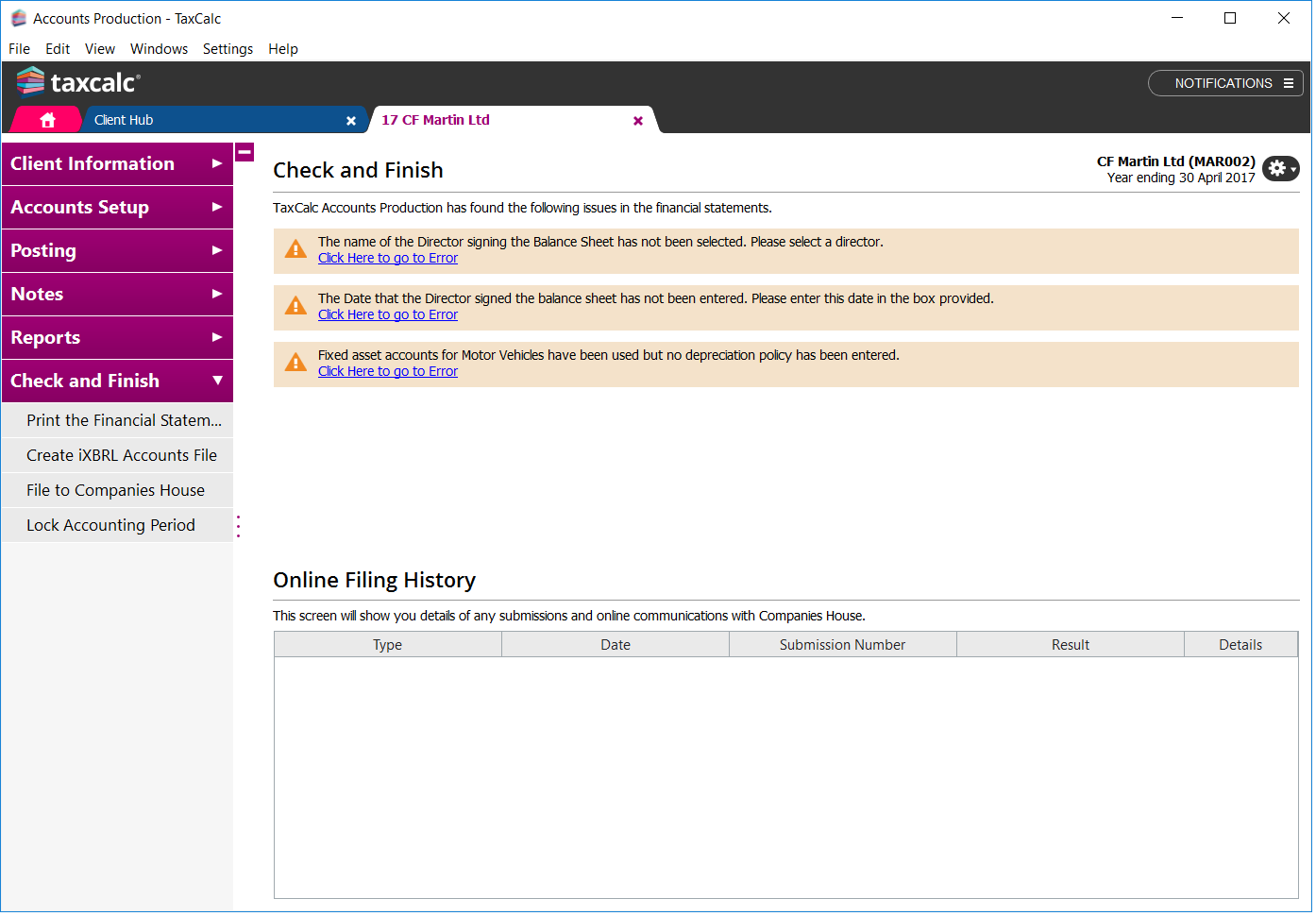

As with all TaxCalc products, TaxCalc Accounts Production features Check & Finish, which reviews and validates the accounts to ensure consistency, highlights potentially missing disclosures and reports back anything that needs your attention.

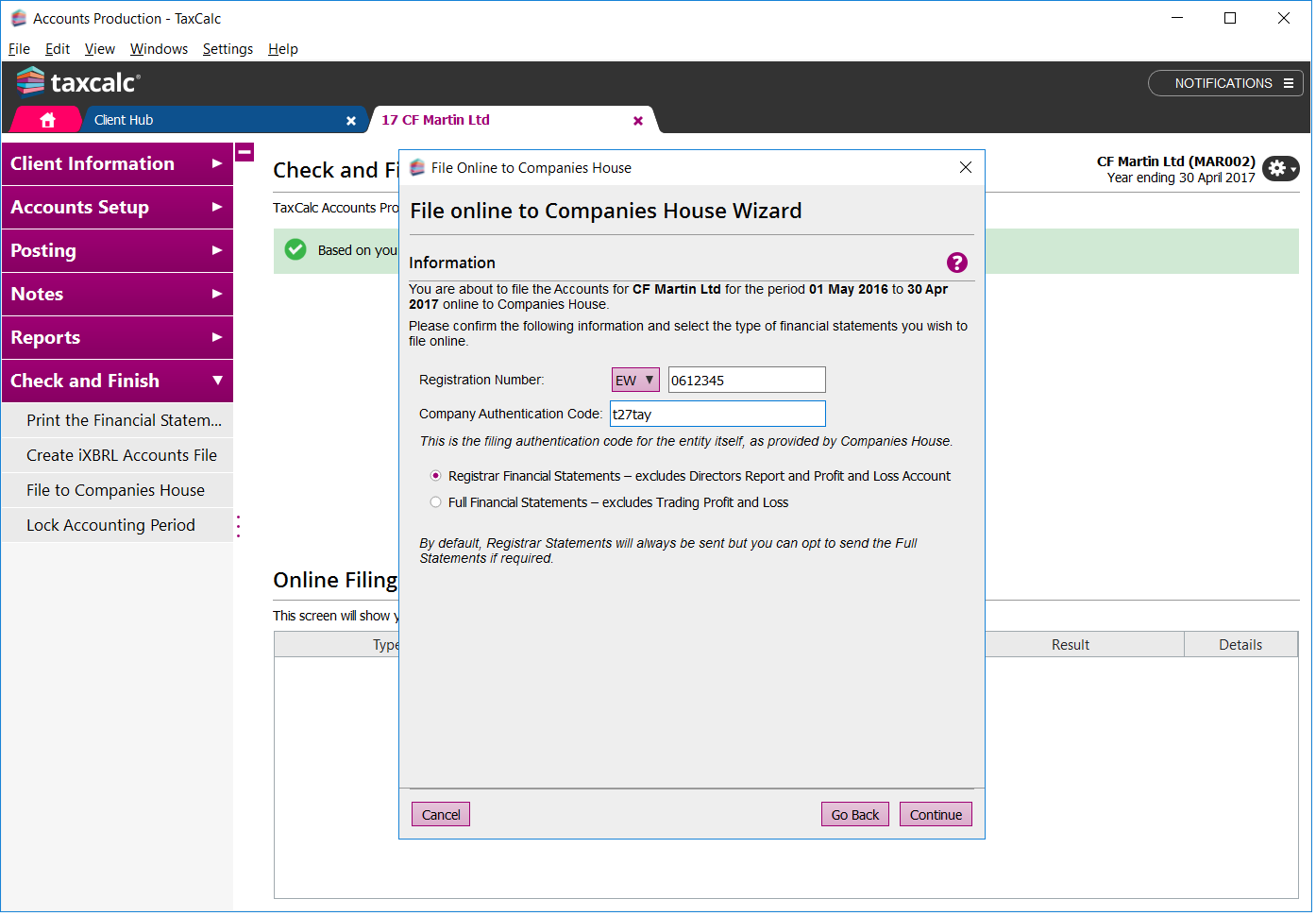

You can file full, registrar (filleted) and dormant Limited Company and LLP accounts online to Companies House using our easy to use wizard.

The system will help you to stay informed as to your submission's progress.

Frequently asked questions

The questions below provide immediate answers to many aspects of Accounts Production. If you'd like to know more, please call our Sales Team on

0345 5190 883 or email sales@taxcalc.com.

Which client types does TaxCalc Accounts Production support?

In Accounts Production you can create accounts for:

- Sole Traders

- Partnerships

- Limited Companies: Limited by Shares and Limited by Guarantee (Micro, Small, Medium and Large Companies)

- Limited Company Group Accounts

- LLPs

- Charitable companies (limited by guarantee), Charitable Incorporated Organisations and Charitable Unincorporated Associations

Is TaxCalc Accounts Production compliant with UK GAAP?

Yes. TaxCalc Accounts Production has been developed to support the following UK GAAP standards:

- FRS 102 section 1a for small companies and LLPs (including SORP 2017)

- FRS 105 for limited companies and LLPs

- FRS 102 for Medium & Large individual limited companies & LLPs (with the FRS 102 MLA add-on licence)

Does TaxCalc Accounts Production tag final accounts in iXBRL format for online submission to Companies House or HMRC?

Yes, absolutely. All iXBRL tagging is automatic so you can submit an electronic copy of your accounts to Companies House or HMRC (via Tax Return Production).

How is my client limit used up?

An Accounts Production licence applies to an allotment of clients per year, depending on the specific Product purchased. A client licence is used once an accounting period is created for the client in a given year.

How many users can be logged into Accounts Production at the same time?

Purchases of our 50, 150, 250, 500 and 1,000 client bandings come with two concurrent users as standard.

Can I produce accounts for multiple businesses?

Yes. If you are an individual client you can produce accounts for multiple businesses.

Accounts Production in action

Find out how Accounts Production can help transform the way you work.

Start a free 14-day trial and see for yourself.

Try everything! See for yourself how easy TaxCalc is to use.

Take a trialNo payment card required

Call us about your practice software needs.

Find out more about what TaxCalc can do for your practice.

Speak to our Sales Team

0345 5190 883