TaxCalc Blog

News and events from TaxCalc

Articles containing the tag "HMRC"

Behind the Scenes of Working with Government

Just before Christmas, there was a lot of discussion on AccountingWeb regarding quarterly reporting and the notion of there being a petition set up to challenge the strategy as announced in the Autumn Statement.

As an apolitical organisation, we won’t be drawn into whether quarterly reporting is a good idea or not but with 229 comments (at time of writing) on this particular thread, it’s clearly proven to be a fiercely debated topic.

One of the comments that caught my eye during the debate was a call for the Big Four firms and accountancy bodies to use their influence with HMRC.

This gave me two thoughts…

Read moreDigital Tax Accounts and Quarterly Reporting

The Government today released a new document about Digital Tax Accounts. Entitled Making Tax Digital, it consolidates information that has been released into the public domain since the March Budget and lays out the roadmap by which HMRC will transform from its current regime to the new digital one.

Having read numerous articles in the press these last few days, many reporters have reiterated the fact that Digital Tax Accounts, both for individuals and businesses, will be the norm by 2020. However, what seems to have slipped somewhat under the radar by a few is the requirement for “most” self employed people and landlords to make quarterly returns from April 2018…

Read moreThe Digital Tax Account – Public Beta and a New Name

On Tuesday 1 December 2015, HMRC formally launched the public beta of the Digital Tax Account, now renamed the Personal Tax Account (PTA).

The new service, as with all new Government projects, is to be delivered in a piecemeal fashion. In this article, we’ll take a look at what it can do…

Read moreThe Office of Tax Simplification on Small Companies

The Office of Tax Simplification have released a survey to collect opinion about the taxes that small businesses pay to HMRC. The overall aim is to help them make recommendations to the powers that be that set our taxes.

The survey is open to those businesses that employ 10 or fewer people and covers all taxes.

If you would like to take part and voice your opinions, please follow this link.

Read moreThe Digital Tax Account Explained

Back in the March Budget, the Chancellor of the Exchequer, George Osborne, announced that the tax return would be replaced by a Digital Tax Account by the end of this parliament. As is often the case with Government policy, such broad statements don’t have any immediate substance to them apart from a few broad concepts.

Over the six months that have followed, HMRC have been beavering away at working out what a Digital Tax Account should look like and how it should work. We have been fortunate to be part of this and have helped to shape this development.

Bit by bit, the picture of how the Digital Tax Account will work has become increasingly more clear and now we can finally begin to explain how some of this will work.

Read moreHMRC Publishes Response to Penalties Consultation

Back in February of this year, HMRC kicked off a public consultation on the penalties it issues to taxpayers and the reasons why. It’s highly likely that the UK tax regime will become more automated in the coming years and with it, so too will be the application of penalties.

Computers need rules to apply. But what should the new rules look like?

Curiously, the document showed that HMRC wanted to make itself look more fair in how penalties were determined and applied, rather than the hard-and-fast approach taken today.

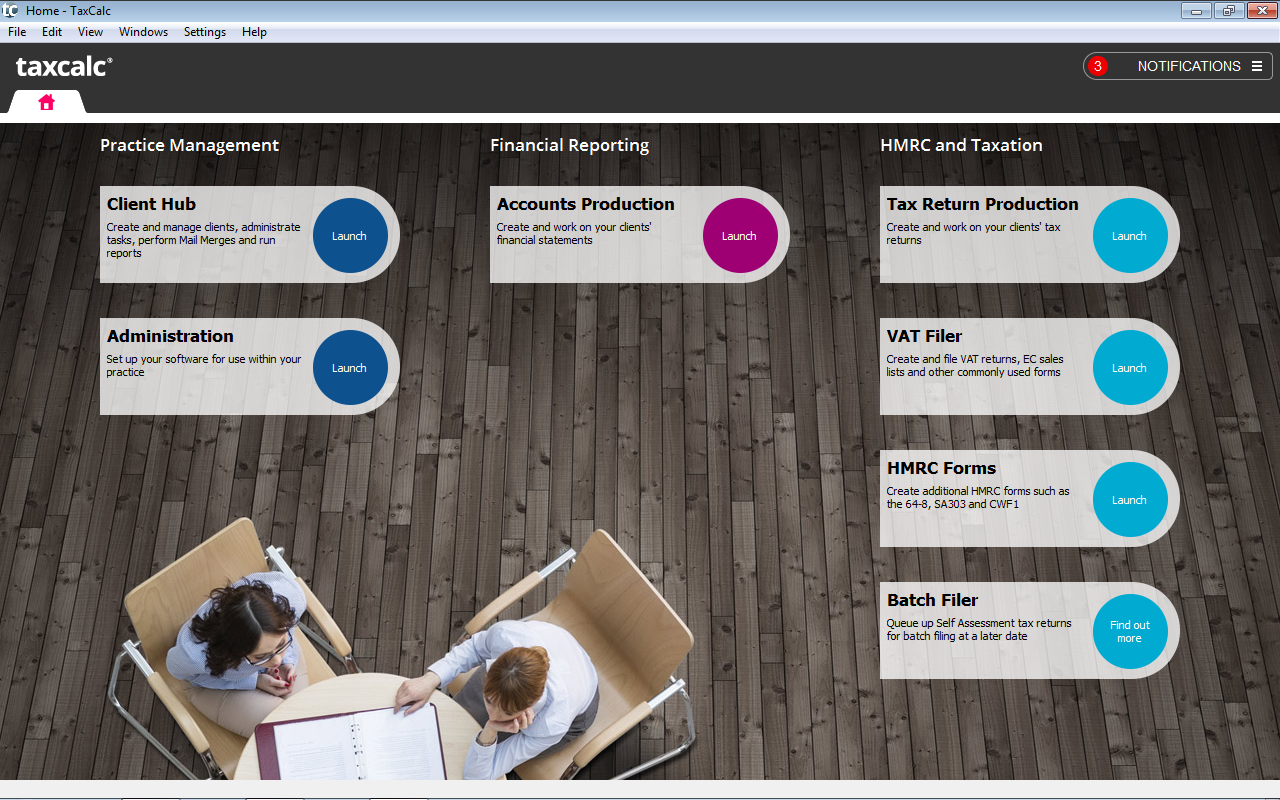

Read moreHMRC Opens Up New Possibilities to Make TaxCalc Even Better

As well as carrying out the usual duties you’d expect of a Commercial Director, part of my role at TaxCalc is to engage with various Government bodies and help them to shape various future strategies.

Over the last six months, I’ve been invited to London several times to discuss matters concerning HMRC’s digital tax strategy and all that it entails. We see it as being very important to represent not just ourselves but also the accountancy and taxpaying communities. We use our voice to ensure that proposals don’t just suit HMRC but also our customers and where those customers are accountants, their clients too....

Read more