AML Centre

From £101 per year

Meet your Anti-Money Laundering obligations the smart way

TaxCalc’s Anti-Money Laundering Centre helps accountants, bookkeepers and other finance professionals meet their obligations under the Money Laundering Regulations, which apply to their firm and their clients.

Using our trusted SimpleStep® workflow, AML Centre guides you through what you need to do to demonstrate your firm’s compliance with AML regulations and helps you perform client due diligence with ease.

- Protect your firm

- Run a firm-wide risk assessment

- Demonstrate your AML compliance

- Empower your staff and manage your risks

- Enhance your due diligence

- Integrates and works in tandem with Practice Manager, AML Identity Checking service and Companies House Advanced Integration

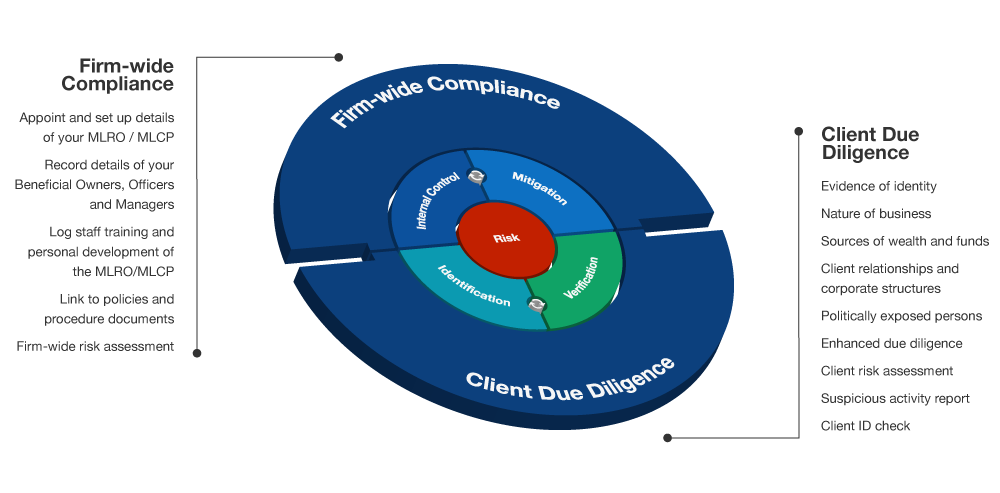

Demonstrate firm-wide compliance and

conduct client due diligence with ease

Protect your firm

Firm-wide compliance. Provided free of charge.

Using the firm-wide compliance module in AML Centre, it’s easy to make sure you’re ticking all the right boxes, performing the correct procedures, understanding all the risks and keeping everything in order, logged and updated.

Friend? Or fraud?

Client due diligence made simple.

Can you be sure that a new client, or an existing one for that matter, is really who they say they are? For all you know, they could be handling money earned from illegal activities. Even funding terrorism. It sounds like something you’d only see in the news, but it happens.

You and your staff are at the front line in preventing fraud. As part of your firm’s AML obligations, you’ll need to perform due diligence for all clients.

AML Identity Checking Service

Providing the final stage of client due diligence and working in tandem with AML Centre, you can be sure of your clients’ identities before you act for them.

Simple and effective for when additional verification is required.

Integration built in

Check your client before you onboard them

You can use AML Centre as a portal for retrieving and recording information to assess prospective clients before officially onboarding them.

You’ll find this useful if you hold sensitive information on a client that needs verifying before it’s stored in Practice Manager.

Companies House Integration

Save time by checking and pulling information from Companies House directly into AML Centre for processing and reviewing, using Companies House Advanced Integration.

Know your clients. Protect your firm.

Anti-Money Laundering (AML) is a serious issue that no accountancy practice can ignore.

You’ll already know that the Money Laundering Regulations require that firms put effective systems and controls in place to combat this growing problem.

It’s vital that you and your staff take appropriate actions and carry out the necessary procedures to demonstrate your compliance by:

- Assessing the risks to your firm

- Keeping appropriate records

- Performing client due diligence

- Monitoring clients on an ongoing basis

- Reporting potentially fraudulent activity

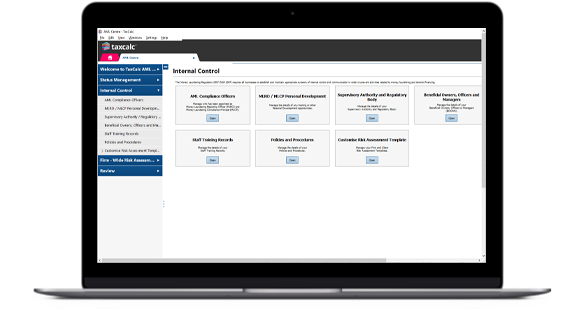

Firm-wide compliance

AML Centre makes it easy to ensure firm-wide compliance and tick all the right boxes, perform the correct procedures, understand all the risks and keep everything in order, logged and updated.

You receive full use of AML Centre’s firm-wide compliance tools when you purchase any client option.

Record what internal controls you have in place

AML Centre provides a simple and effective hub for recording, storing and maintaining all the evidence to demonstrate your compliance. For example, you can:

- Appoint and set up details of your Money Laundering Reporting Officer and Money Laundering Compliance Principal

- Keep appropriate records

- Record details of your Beneficial Owners, Officers and Managers

- Log staff training and personal development of the MLRO/MLCP

- Link to policies and procedure documents

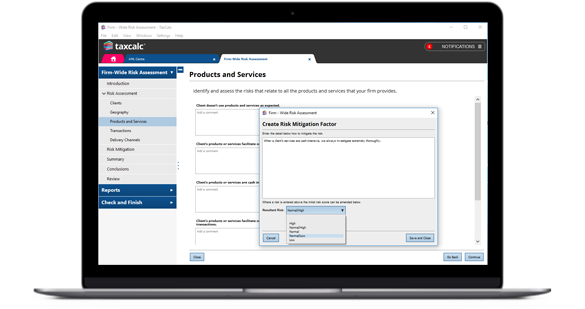

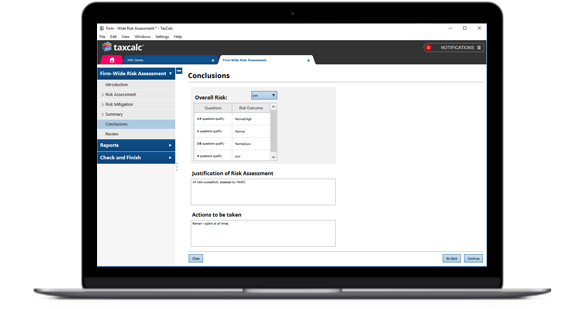

Complete a firm-wide risk assessment

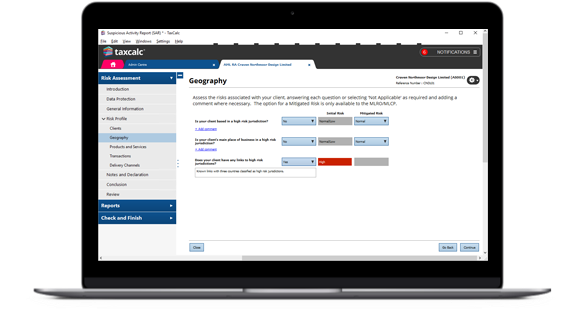

As part of your AML compliance audit, you’ll need to assess the potential risks to your firm. AML Centre lets you identify and categorise risks across five different factors for quick and easy assessment, providing you with the framework to mitigate and manage risk as and when it arises. You’ll be able to generate reports to gain an overview and implement any necessary interventions.

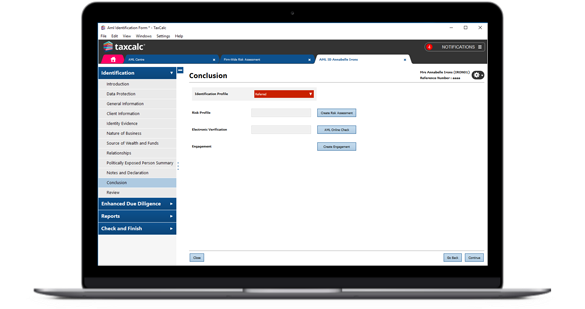

Client due diligence

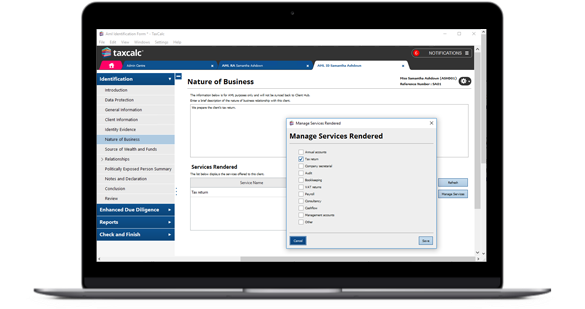

AML Centre covers off all the steps you need to take, allowing you to record data, review the risks posed by a client and report concerns to your nominated Money Laundering Reporting Officer (MLRO).

Know Your Client

- Client information

- Evidence of identity

- Nature of business

- Sources of wealth and funds

- Client relationships and corporate structures

- Politically exposed persons

Complete client risk assessments

Swiftly answer straightforward questions to get a client’s risk calculated for you. If you identify a high-risk client, you can then take the appropriate actions to seek further clarification, by performing enhanced due diligence and recording your findings.

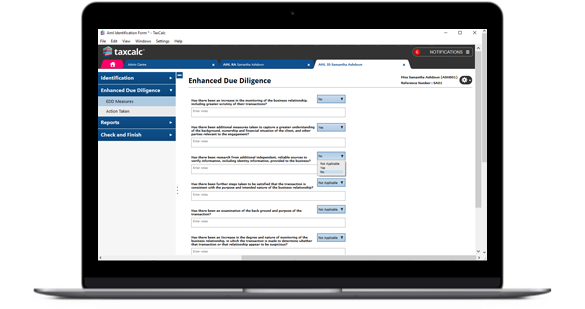

Conduct Enhanced Due Diligence

Should it be required, AML Centre guides you through enhanced due diligence, recording the additional information you’ve gathered, plus the measures and actions you’ve taken. Should you be investigated, the evidence you’ve logged can be used to prove that you’ve taken the necessary precautions and actions required to fulfil your obligations.

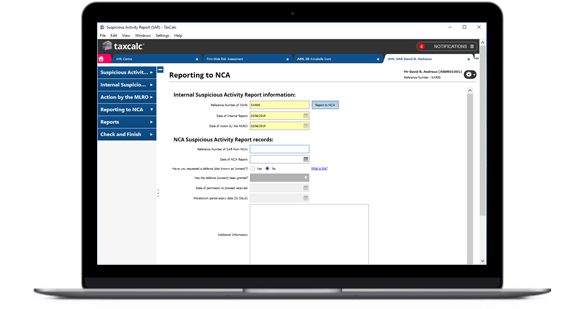

Submit a Suspicious Activity Report (SAR)

AML Centre makes it easy for members of staff to report any suspicions to your MLRO, who can quickly assess the findings and report any suspicions to the National Crime Agency.

AML Identity Checking Service

Providing the final stage of client due diligence and working in tandem with AML Centre, you can be sure of your clients’ identities before you act for them.

Simple and effective for when additional verification is required.

Firm-wide compliance features

Client due diligence features

AML Centre in practice

Video guides.

Firm-wide Compliance

How to identify, assess and mitigate firm-wide risks around money laundering.

Client Due Diligence

How to carry out client identification, risk assessment and enhanced due diligence.

Suspicious Activity Reports

How to create a suspicious activity report.

Anti-Money Laundering Questions

AML Centre in your firm.

Why do I need an AML solution?

Money Laundering Regulations require that firms put effective systems and controls in place to prevent criminal proceeds from being sanitised to disguise their illicit origins.

AML Centre provides a repository for your money laundering policies and procedures, and allows you to identify and mitigate risk to your firm.

Who do the Anti-Money Laundering regulations apply to?

The regulations apply to a number of sectors, including accountants, financial service businesses, estate agents and solicitors.

Why should a firm perform a money laundering risk assessment?

Performing a risk assessment will help identify the areas of the business that are most at risk, so that those risks can be successfully mitigated, and the risk of money laundering reduced.

Do the Anti-Money Laundering regulations apply if a firm does a mixture of regulated and unregulated work?

If a firm does a mixture of regulated and unregulated work, the money laundering regulations only apply to the regulated aspects.

What is an AML Compliance Principal?

To maintain an organisation's obligations relating to the supervision and reporting of money laundering activities, the AML Compliance Principal has the responsibility of overseeing internal anti-money laundering policies, and keeping the organisation compliant.

What is a Money Laundering Reporting Officer (MLRO)?

Also referred to as a Nominated Officer, the MLRO provides an oversight for a firm’s Anti-Money Laundering systems, and acts as a focal point for related inquiries. The MLRO’s role is to be aware of any suspicious activity in the business that might be linked to money laundering or terrorist financing, and if necessary report it.

What is a Suspicious Activity Report (SAR)?

A Suspicious Activity Report is a piece of information alerting Law Enforcement Agencies (LEAs) that certain client/customer activity is in some way suspicious and might indicate money laundering or terrorist financing.