Trust

From £52

You can buy TaxCalc Trust today for just £52.00 incl. UK VAT

Make light work of your tax return

With a heritage dating back nearly 30 years, TaxCalc has been trusted by hundreds of thousands of taxpayers to help them with their tax return.

TaxCalc Trust provides fast and direct completion of the SA900 Trust and Estates form, together with numerous wizards and worksheets to help you make the correct choices and ensures that the Trust pays the right amount of tax.

Experts you can trust

TaxCalc Trust is based upon the same core technology as our award winning software for Practices, which are used by thousands of firms of accountants up and down the country.

TaxCalc's support team is staffed by tax professionals who are on hand to help you fill out your forms.We are so confident in our software that there is no additional charge for support. Our lines are open from 9:30am to 5:00pm.

Other forms available

Licences of TaxCalc Trust can be bought on their own or as part of a package with other types of tax returns.

Please visit our Questions page in this section to find out more about products that feature the SA900 Trust return.

Ready for 2024-2025

We work closely with HMRC to ensure that your software is always up to date.

TaxCalc Trust has been fully updated to cater for the 2024-25 tax year for Self Assessment.

Previous years available

If you need to complete a tax return for

an earlier tax year, we stock products to

buy and download that are suitable for

tax years dating back as far as 2019.

Returns by paper

If you wish to file your return by paper, make sure your return reaches HMRC by the deadline of 31 October or face a £100 penalty

When do I need to file my return?

If you need to complete a tax return and miss the paper filing deadline, you must file your trust tax returns by 31 January to avoid penalties

Fully comprehensive, yet easy to use software

TaxCalc Trust is the simplest and most complete way to file your tax return online.All the necessary forms

TaxCalc Trust includes the standard SA900 Trust and Estates return, all supplementary pages and the R185 form, which is used to report trust income to the beneficiaries or settlor of the trust.

Easy to complete

Fill out your return directly using HMRC Forms mode. To help with the calculations, our Wizards and Worksheets help break down the data capture and perform many otherwise manual calculations for you.

Check before you file

Use Check & Finish to validate your entries and address any potential problems before you file your return.

Ready for 2024-25

We work closely with HMRC to ensure that your software is always up to date.

TaxCalc Trust has been fully updated to cater for the 2024-25 tax year for Self Assessment.

Expandable and upgradeable

TaxCalc Trust can be upgraded with additional Individual, Partnership, Corporation Tax and Trust forms.

Please call 0345 5190 882 to discuss your requirements.

Features in detail

At a glance

- Facsimile HMRC Forms mode for direct entry of your tax return

- Check & Finish routine to validate entries in your tax return

- All SA900 Trust and Estates supplementary pages including Trade, Lloyd's and Non-residence

- Integration between R185, R40 Forms and SA100 Individual tax returns

- Link R185 Forms to settlors and beneficiaries

- On-the-fly tax liability calculation

- Calculation and repayment summary

- Compare last year's tax data with the current return

- Export reports to PDF, Microsoft Word and Microsoft Excel

- Password protection your returns

- Full HMRC Forms and tax guidance help manual

- Unlimited email and telephone support

- Anonymous "send return to TaxCalc" function to get help from our Support team

- Includes High Income Benefit Charge

- Auto-save function

- Context-sensitive help

Supplementary pages provided:

- SA900Trust Return*

- SA901 Trade*

- SA901LLloyd's Underwriters: income from members of Lloyd's*

- SA902Partnerships*

- SA903Property*

- SA904Foreign Income*

- SA905Capital Gains*

- SA906Non-residence*

- SA907Charities*

- SA923Estate Pension Charges etc.*

- SA951Tax Calculation Guide*

* TaxCalc software provides these supplementary pages, which even HMRC's own software packages currently do not support

Accessorise your TaxCalc

TaxCalc sports a number of helpful add-ons. You can choose one or more add-on modules

and review pricing when you come to buy your software.

TaxCalc Dividend Database (2024-25 year)

Make the entry of dividend data a snap with this database of FTSE 350 and AIM 100 listed dividend data for the 2024-25 tax year. Bring forward your shareholdings from your 2023-24 tax return and TaxCalc Dividend Database will do the rest.

The database is released in June each year to include dividends paid up to the end of the previous tax year.

£7.50

TaxCalc in action

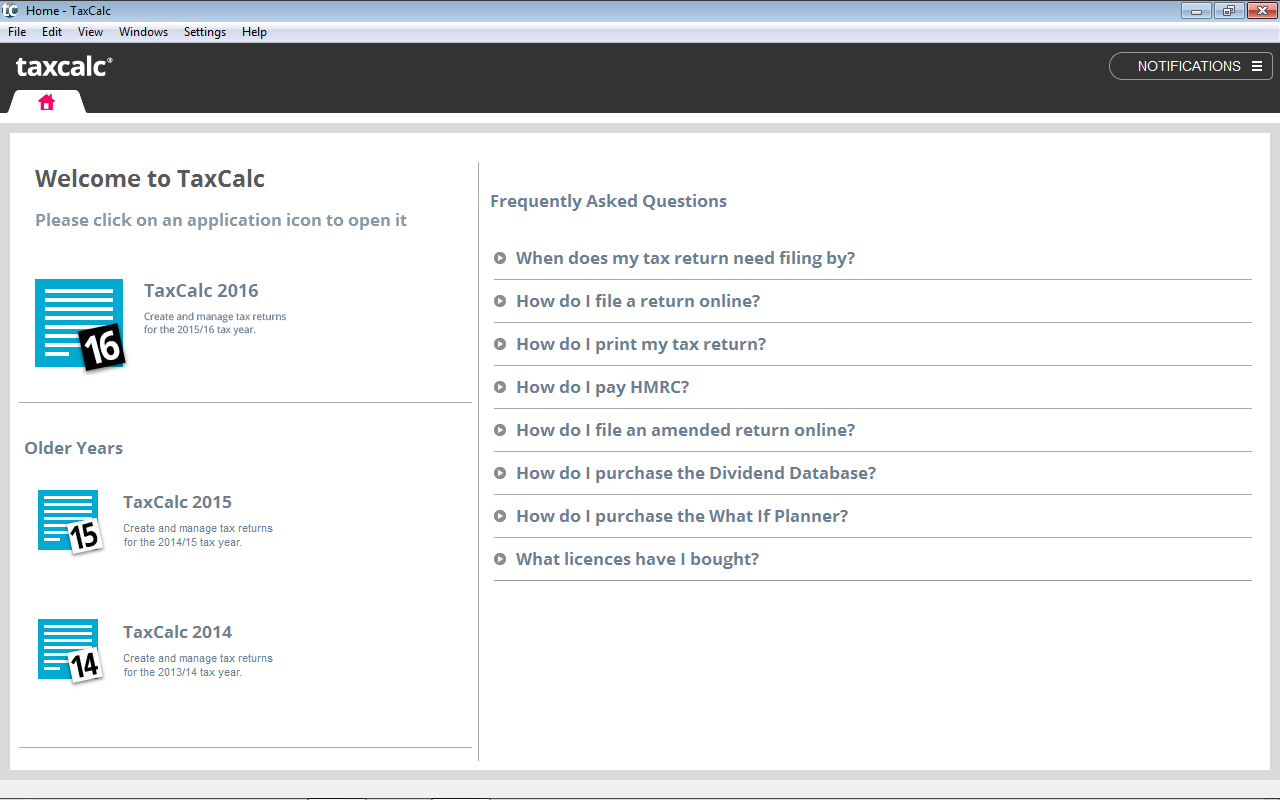

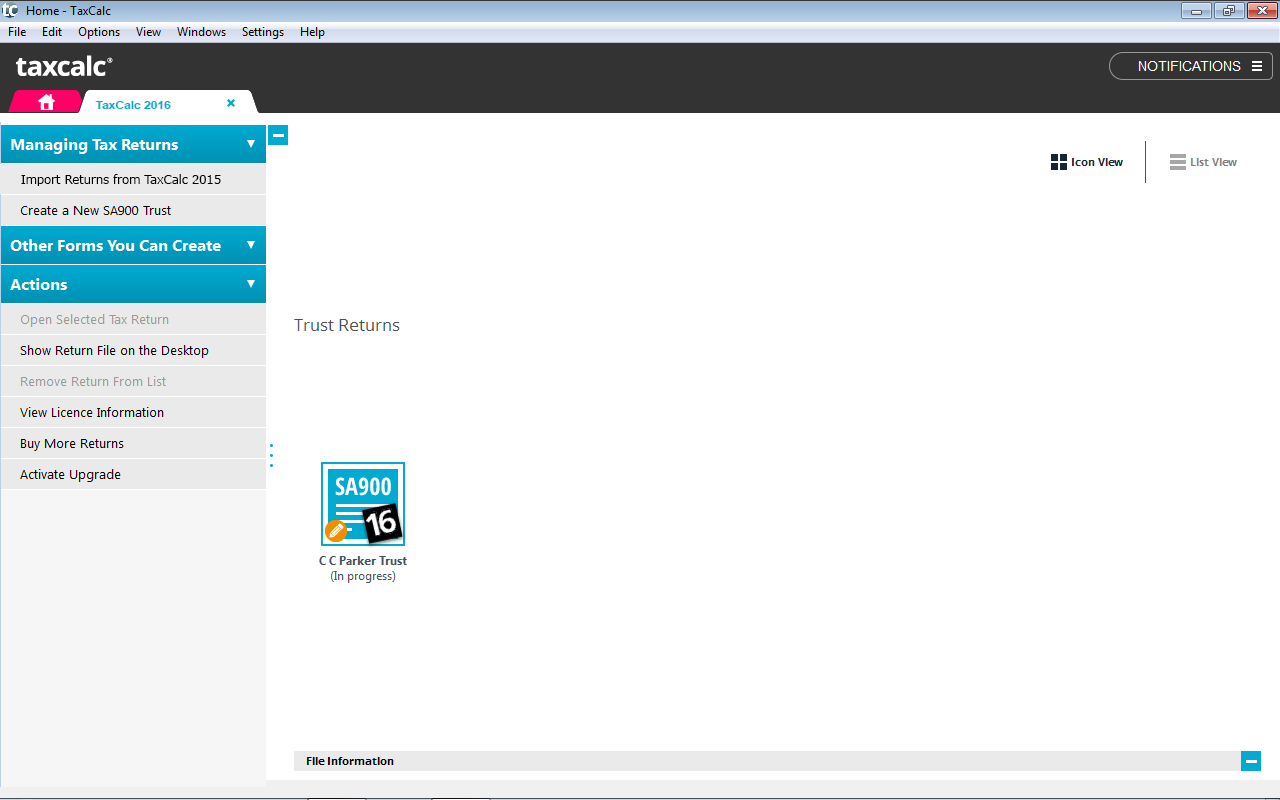

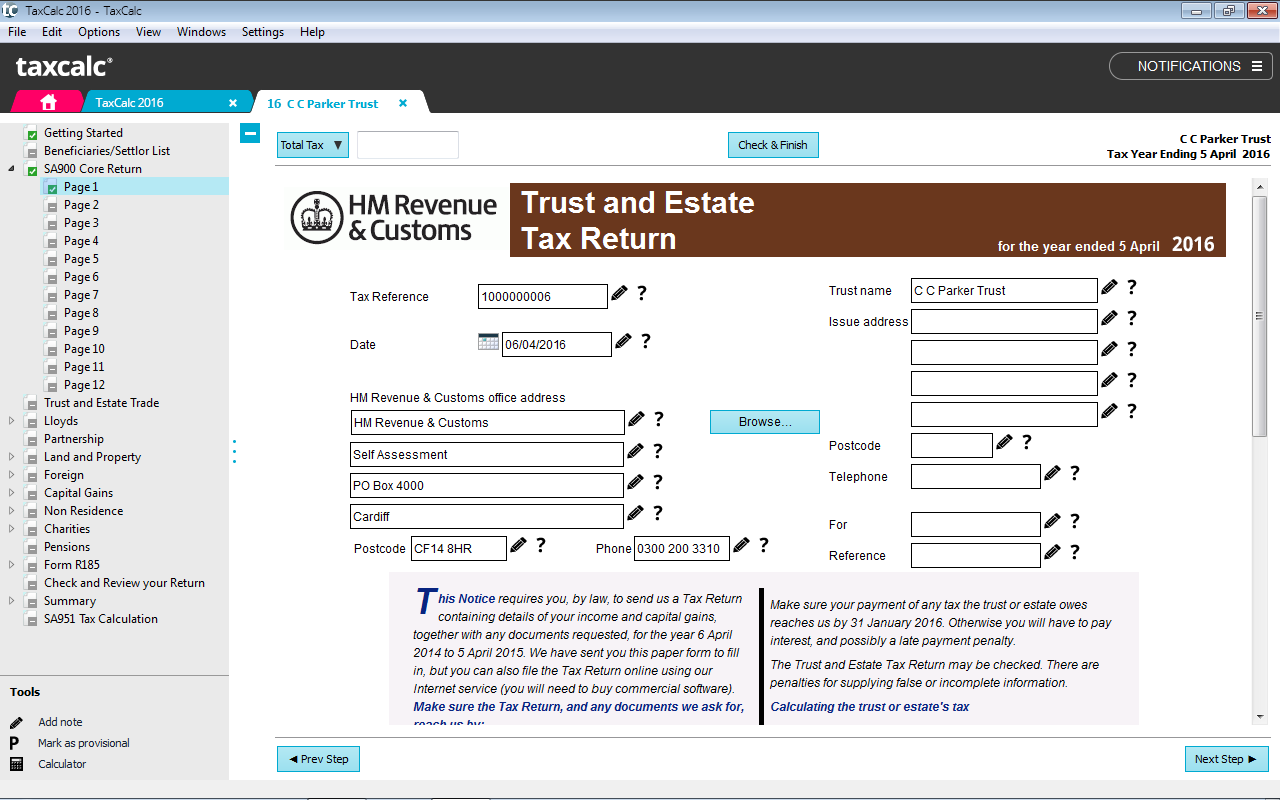

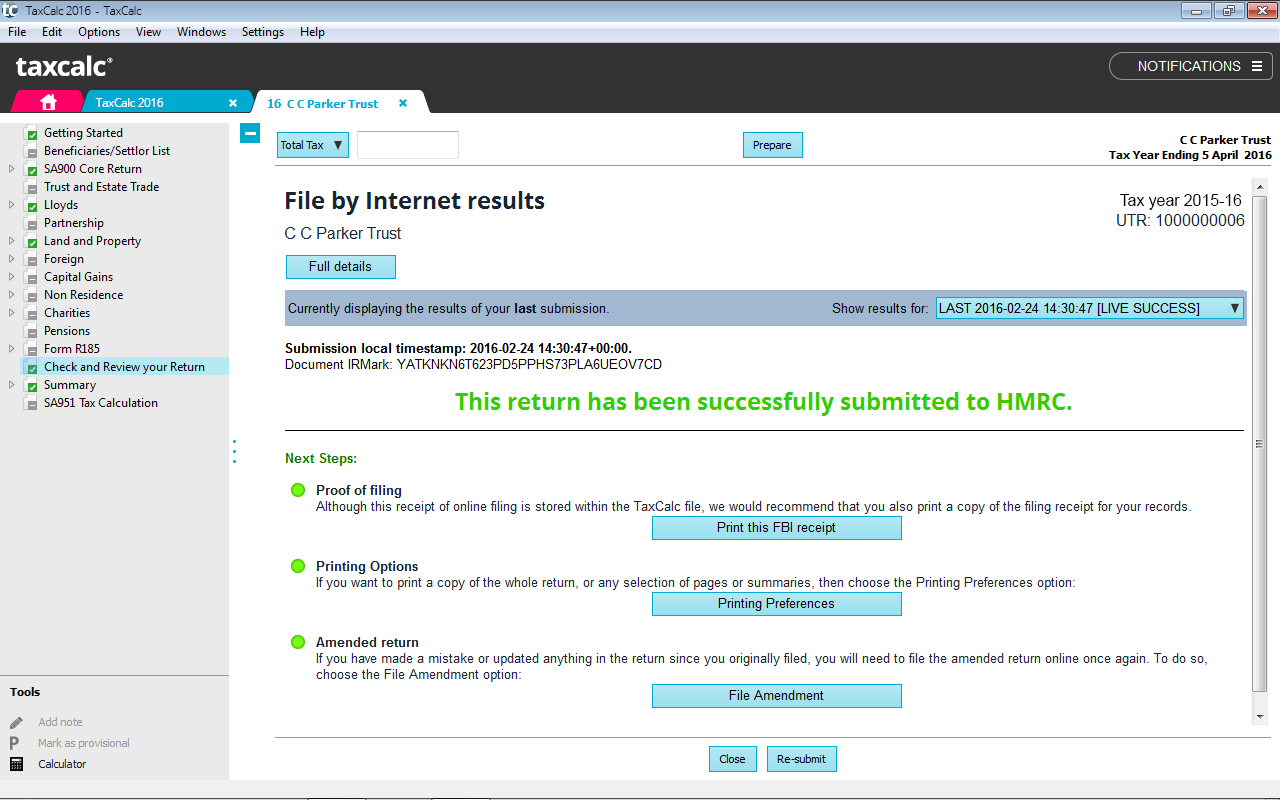

We pride ourselves on delivering high quality and easy to use software. Please click on a screenshot below tosee how you use TaxCalc and see how easy it is to complete your tax return.

TaxCalc organises and provides access to tax returns for the 2024-25 and previous years up until 2018-19.

TaxCalc manages the production and progress of your tax returns, together with additional supporting forms.

HMRC Forms mode mode displays a facsimile form for fast direct entry.

When you get to the end of your return, Check and Finish validates the entries you've made and highlights any potential issues before you file.

TaxCalc files online and tells you when your return has been successfully received by HMRC.

*TaxCalc is sold according to tax years, each of which is bought separately. Please see our Versions and Prices for more info.

Frequently asked questions

The questions below provide immediate answers to many aspects of TaxCalc Trust.If you have any further questions, please call 0345 5190 882 or email sales@taxcalc.com

Does TaxCalc work on

Windows 10?

Yes. TaxCalc's software has been fully tested with Microsoft's latest operating system and we can confirm that it does indeed work with Microsoft Windows 10. For a full compatibility list please see the System Requirements for TaxCalc.

Does TaxCalc work on Apple Macs?

Yes. TaxCalc will run on any 64-bit Macintosh running Mac OS 10.12 or higher.

Does TaxCalc work on Linux

Yes. TaxCalc will run on any 64 bit kernal 3.10 (or higher), Debian (e.g. Ubuntu) or Redhat based distributions.

Do I have to buy the software

every year?

TaxCalc is an annual purchase because we have to redevelop it each year to new rates and tax rules. Your licence is perpetual and will continue to provide future access to unused returns for purchased tax years.

Since TaxCalc is an all-in-one application, when you buy next year's licence, all you need to do is open TaxCalc and it will update itself to add in the 2024-25 returns.

Can I upgrade or add

additional returns?

Yes. TaxCalc Trust can be upgraded with additional Individual, Partnership, Corporation Tax and Trust forms.

Other products in our range treat the SA900 Trust and Estates return as an add-on module, which can be bought at point of purchase.

TaxCalc Individual

Caters for the SA100 Individual return for you and your family.

TaxCalc Partnership

Caters for the SA800 Partnership return and up to six SA100 Individual returns for the partnership, the partners and their family members.

TaxCalc Limited Company

Caters for the CT600 Corporation Tax return and up to six SA100 Individual returns for the company, the directors and their family members.

TaxCalc Tax Return Production

Aimed at accountants, tax advisors and legal professionals, TaxCalc Tax Return Production has been built to manage the fast and efficient production of all types of returns for clients.

Alternatively, to discuss your requirements, please call us on 0345 5190 883 or email sales@taxcalc.com.

Can I buy previous years'

returns?

Yes. We supply tax software dating back to the 2018-19 tax year. You can find this on the Versions and Prices page.

How many computers can I

install TaxCalc Trust onto?

For your convenience, TaxCalc Trust may be installed on two computers.